Business Privilege Tax Return And Business License Application Form - Randor Township

ADVERTISEMENT

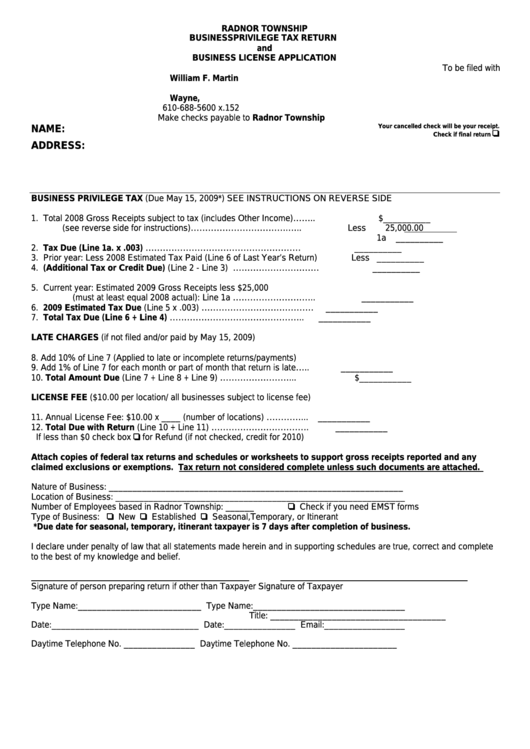

RADNOR TOWNSHIP

BUSINESS PRIVILEGE TAX RETURN

and

BUSINESS LICENSE APPLICATION

To be filed with

William F. Martin

P.O. Box 155

Wayne, P.A. 19087-0155

610-688-5600 x.152

Make checks payable to Radnor Township

Your cancelled check will be your receipt.

NAME:

Check if final return

ADDRESS:

BUSINESS PRIVILEGE TAX (Due May 15, 2009*) SEE INSTRUCTIONS ON REVERSE SIDE

1. Total 2008 Gross Receipts subject to tax (includes Other Income)……..

$__________

(see reverse side for instructions)…………………………….…..

Less

25,000.00

1a

__________

2. Tax Due (Line 1a. x .003) ………………………………………………

__________

3. Prior year: Less 2008 Estimated Tax Paid (Line 6 of Last Year’s Return)

Less __________

4. (Additional Tax or Credit Due) (Line 2 - Line 3) …………………………

__________

5. Current year: Estimated 2009 Gross Receipts less $25,000

(must at least equal 2008 actual): Line 1a ………………………..

___________

6. 2009 Estimated Tax Due (Line 5 x .003) …………………………………

___________

7. Total Tax Due (Line 6 + Line 4) ………………………………………..

___________

LATE CHARGES (if not filed and/or paid by May 15, 2009)

8.

Add 10% of Line 7 (Applied to late or incomplete returns/payments).....

___________

9.

Add 1% of Line 7 for each month or part of month that return is late…..

___________

10.

Total Amount Due (Line 7 + Line 8 + Line 9) ……………………...

$___________

LICENSE FEE ($10.00 per location/ all businesses subject to license fee)

11.

Annual License Fee: $10.00 x ____ (number of locations) …………...

___________

12.

Total Due with Return (Line 10 + Line 11) …………………………….

___________

If less than $0 check box

for Refund (if not checked, credit for 2010)

Attach copies of federal tax returns and schedules or worksheets to support gross receipts reported and any

claimed exclusions or exemptions. Tax return not considered complete unless such documents are attached.

Nature of Business: ______________________________________________________________

Location of Business: _____________________________________________________________

Number of Employees based in Radnor Township: ______

Check if you need EMST forms

Type of Business:

New

Established

Seasonal,Temporary, or Itinerant

*Due date for seasonal, temporary, itinerant taxpayer is 7 days after completion of business.

I declare under penalty of law that all statements made herein and in supporting schedules are true, correct and complete

to the best of my knowledge and belief.

Signature of person preparing return if other than Taxpayer

Signature of Taxpayer

Type Name:__________________________

Type Name:________________________________

Title: _____________________________________

Date:_______________________________

Date:_______________ Email:_________________

Daytime Telephone No. _______________

Daytime Telephone No. ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2