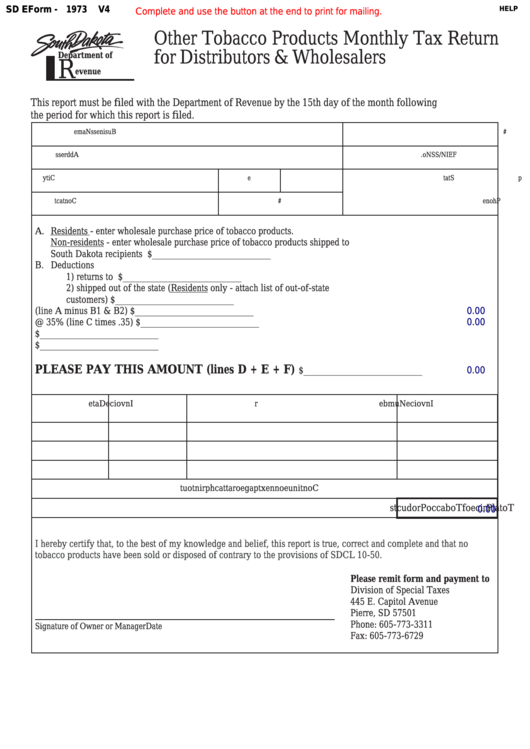

SD EForm -

1973

V4

HELP

Complete and use the button at the end to print for mailing.

Other Tobacco Products Monthly Tax Return

for Distributors & Wholesalers

Department of

R

evenue

This report must be filed with the Department of Revenue by the 15th day of the month following

the period for which this report is filed.

B

u

i s

e n

s s

N

a

m

e

T

b o

c a

o c

D

s i

/ . t

W

h

. l o

L

c i

n e

e s

#

A

d d

e r

s s

F

E

N I

S /

S

N

. o

C

y t i

S

a t

e t

Z

p i

M

n o

/ h t

e Y

r a

C

n o

a t

t c

P

o h

e n

#

A. Residents - enter wholesale purchase price of tobacco products.

Non-residents - enter wholesale purchase price of tobacco products shipped to

South Dakota recipients ........................................................................................... $ _________________________

B. Deductions

1) returns to supplier ......................................................................................... $ _________________________

2) shipped out of the state (Residents only - attach list of out-of-state

customers) .................................................................................................... $ _________________________

0.00

C. Taxable value of Tobacco Products (line A minus B1 & B2) .................................. $ _________________________

0.00

D. Tax @ 35% (line C times .35).................................................................................. $ _________________________

E. Interest for late payment .......................................................................................... $ _________________________

F. Penalty for late filing ............................................................................................... $ _________________________

PLEASE PAY THIS AMOUNT (lines D + E + F) ......................

0.00

$ _________________________

I

v n

i o

e c

D

a

e t

I

v n

i o

e c

N

u

m

b

r e

n I

s -

a t

e t

c i l

n e

e s

s e

-

P

r u

h c

s a

d e

f

o r

m

W

o h

e l

a s

e l

p

u

c r

a h

e s

p

i r

e c

O

u

- t

f o

s -

a t

e t

c i l

n e

e s

s e

-

S

o

d l

o t

C

o

n

n i t

e u

o

n

e n

t x

a p

e g

r o

a

a t t

h c

r p

n i

o t

t u

T

o

l a t

P

i r

e c

f o

T

o

b

c a

o c

P

o r

d

c u

s t

0.00

I hereby certify that, to the best of my knowledge and belief, this report is true, correct and complete and that no

tobacco products have been sold or disposed of contrary to the provisions of SDCL 10-50.

Please remit form and payment to

Division of Special Taxes

445 E. Capitol Avenue

Pierre, SD 57501

Phone: 605-773-3311

Signature of Owner or Manager

Date

Fax: 605-773-6729

1

1 2

2