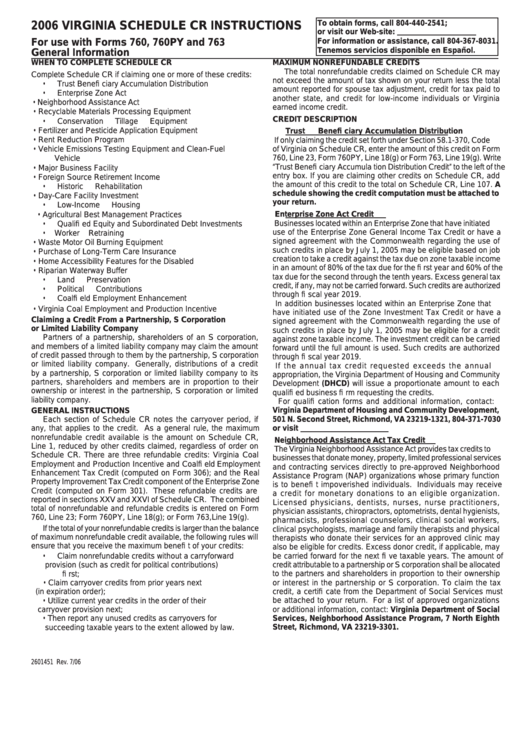

Virginia Schedule Cr Instructions - Credit Computation Schedule - For Use With Forms 760, 760py, 763 And 765 - 2006

ADVERTISEMENT

To obtain forms, call 804-440-2541;

2006 VIRGINIA SCHEDULE CR INSTRUCTIONS

or visit our Web-site:

For information or assistance, call 804-367-8031.

For use with Forms 760, 760PY and 763

Tenemos servicios disponible en Español.

General Information

WHEN TO COMPLETE SCHEDULE CR

MAXIMUM NONREFUNDABLE CREDITS

The total nonrefundable credits claimed on Schedule CR may

Complete Schedule CR if claiming one or more of these credits:

not exceed the amount of tax shown on your return less the total

•

Trust Benefi ciary Accumulation Distribution

amount reported for spouse tax adjustment, credit for tax paid to

•

Enterprise Zone Act

another state, and credit for low-income individuals or Virginia

•

Neighborhood Assistance Act

earned income credit.

•

Recyclable Materials Processing Equipment

CREDIT DESCRIPTION

•

Conservation Tillage Equipment

•

Fertilizer and Pesticide Application Equipment

Trust Benefi ciary Accumulation Distribution

•

Rent Reduction Program

If only claiming the credit set forth under Section 58.1-370, Code

•

Vehicle Emissions Testing Equipment and Clean-Fuel

of Virginia on Schedule CR, enter the amount of this credit on Form

760, Line 23, Form 760PY, Line 18(g) or Form 763, Line 19(g). Write

Vehicle

“Trust Benefi ciary Accumula tion Distribution Credit” to the left of the

•

Major Business Facility

entry box. If you are claiming other credits on Schedule CR, add

•

Foreign Source Retirement Income

the amount of this credit to the total on Schedule CR, Line 107. A

•

Historic Rehabilitation

schedule showing the credit computation must be attached to

•

Day-Care Facility Investment

your return.

•

Low-Income Housing

•

Agricultural Best Management Practices

Enterprise Zone Act Credit

•

Qualifi ed Equity and Subordinated Debt Investments

Businesses located within an Enterprise Zone that have initiated

use of the Enterprise Zone General Income Tax Credit or have a

•

Worker Retraining

signed agreement with the Commonwealth regarding the use of

•

Waste Motor Oil Burning Equipment

such credits in place by July 1, 2005 may be eligible based on job

•

Purchase of Long-Term Care Insurance

creation to take a credit against the tax due on zone taxable income

•

Home Accessibility Features for the Disabled

in an amount of 80% of the tax due for the fi rst year and 60% of the

•

Riparian Waterway Buffer

tax due for the second through the tenth years. Excess general tax

•

Land Preservation

credit, if any, may not be carried forward. Such credits are authorized

•

Political Contributions

through fi scal year 2019.

•

Coalfi eld Employment Enhancement

In addition businesses located within an Enterprise Zone that

•

Virginia Coal Employment and Production Incentive

have initiated use of the Zone Investment Tax Credit or have a

Claiming a Credit From a Partnership, S Corporation

signed agreement with the Commonwealth regarding the use of

or Limited Liability Company

such credits in place by July 1, 2005 may be eligible for a credit

Partners of a partnership, shareholders of an S corporation,

against zone taxable income. The investment credit can be carried

and members of a limited liability company may claim the amount

forward until the full amount is used. Such credits are authorized

of credit passed through to them by the partnership, S corporation

through fi scal year 2019.

or limited liability company. Generally, distributions of a credit

If the annual tax credit requested exceeds the annual

by a partnership, S corporation or limited liability company to its

appropriation, the Virginia Department of Housing and Community

partners, shareholders and members are in proportion to their

Development (DHCD) will issue a proportionate amount to each

ownership or interest in the partnership, S corporation or limited

qualifi ed business fi rm requesting the credits.

liability company.

For qualifi cation forms and additional information, contact:

GENERAL INSTRUCTIONS

Virginia Department of Housing and Community Development,

Each section of Schedule CR notes the carryover period, if

501 N. Second Street, Richmond, VA 23219-1321, 804-371-7030

any, that applies to the credit. As a general rule, the maximum

or visit

nonrefundable credit available is the amount on Schedule CR,

Neighborhood Assistance Act Tax Credit

Line 1, reduced by other credits claimed, regardless of order on

The Virginia Neighborhood Assistance Act provides tax credits to

Schedule CR. There are three refundable credits: Virginia Coal

businesses that donate money, property, limited professional services

Employment and Production Incentive and Coalfi eld Employment

and contracting services directly to pre-approved Neighborhood

Enhancement Tax Credit (computed on Form 306); and the Real

Assistance Program (NAP) organizations whose primary function

Property Improvement Tax Credit component of the Enterprise Zone

is to benefi t impoverished individuals. Individuals may receive

Credit (computed on Form 301). These refundable credits are

a credit for monetary donations to an eligible organization.

reported in sections XXV and XXVI of Schedule CR. The combined

Licensed physicians, dentists, nurses, nurse practitioners,

total of nonrefundable and refundable credits is entered on Form

physician assistants, chiropractors, optometrists, dental hygienists,

760, Line 23; Form 760PY, Line 18(g); or Form 763, Line 19(g).

pharmacists, professional counselors, clinical social workers,

If the total of your nonrefundable credits is larger than the balance

clinical psychologists, marriage and family therapists and physical

of maximum nonrefundable credit available, the following rules will

therapists who donate their services for an approved clinic may

ensure that you receive the maximum benefi t of your credits:

also be eligible for credits. Excess donor credit, if applicable, may

Claim nonrefundable credits without a carryforward

be carried forward for the next fi ve taxable years. The amount of

•

provision (such as credit for political contributions)

credit attributable to a partnership or S corporation shall be allocated

fi rst;

to the partners and shareholders in proportion to their ownership

Claim carryover credits from prior years next

or interest in the partnership or S corporation. To claim the tax

•

(in expiration order);

credit, a certifi cate from the Department of Social Services must

Utilize current year credits in the order of their

be attached to your return. For a list of approved organizations

•

carryover provision next;

or additional information, contact: Virginia Department of Social

Then report any unused credits as carryovers for

Services, Neighborhood Assistance Program, 7 North Eighth

•

succeeding taxable years to the extent allowed by law.

Street, Richmond, VA 23219-3301.

2601451 Rev. 7/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4