Form Dr 1091 - Backup Withholding Tax Return-Gaming

ADVERTISEMENT

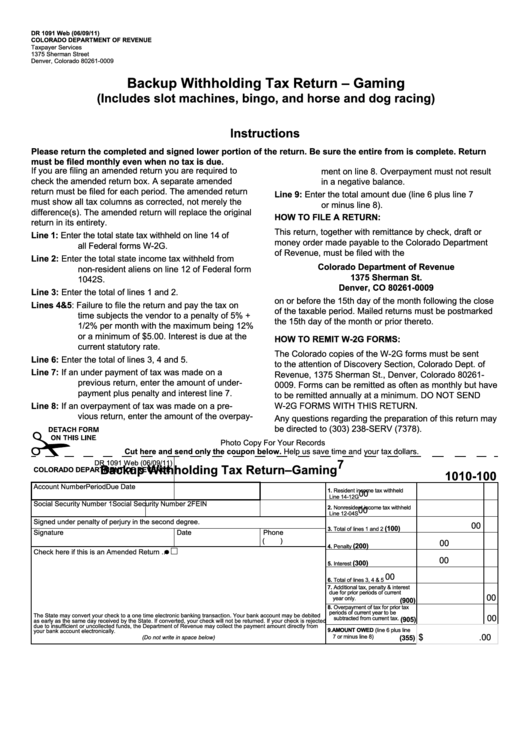

DR 1091 Web (06/09/11)

COLORADO DEPARTMENT OF REVENUE

Taxpayer Services

1375 Sherman Street

Denver, Colorado 80261-0009

Backup Withholding Tax Return – Gaming

(Includes slot machines, bingo, and horse and dog racing)

Instructions

Please return the completed and signed lower portion of the return. Be sure the entire from is complete. Return

must be filed monthly even when no tax is due.

If you are filing an amended return you are required to

ment on line 8. Overpayment must not result

check the amended return box. A separate amended

in a negative balance.

return must be filed for each period. The amended return

Line 9:

Enter the total amount due (line 6 plus line 7

must show all tax columns as corrected, not merely the

or minus line 8).

difference(s). The amended return will replace the original

HOW TO FILE A RETURN:

return in its entirety.

This return, together with remittance by check, draft or

Line 1:

Enter the total state tax withheld on line 14 of

money order made payable to the Colorado Department

all Federal forms W-2G.

of Revenue, must be filed with the

Line 2:

Enter the total state income tax withheld from

Colorado Department of Revenue

non-resident aliens on line 12 of Federal form

1375 Sherman St.

1042S.

Denver, CO 80261-0009

Line 3:

Enter the total of lines 1 and 2.

on or before the 15th day of the month following the close

Lines 4&5: Failure to file the return and pay the tax on

of the taxable period. Mailed returns must be postmarked

time subjects the vendor to a penalty of 5% +

the 15th day of the month or prior thereto.

1/2% per month with the maximum being 12%

or a minimum of $5.00. Interest is due at the

HOW TO REMIT W-2G FORMS:

current statutory rate.

The Colorado copies of the W-2G forms must be sent

Line 6:

Enter the total of lines 3, 4 and 5.

to the attention of Discovery Section, Colorado Dept. of

Line 7:

If an under payment of tax was made on a

Revenue, 1375 Sherman St., Denver, Colorado 80261-

previous return, enter the amount of under-

0009. Forms can be remitted as often as monthly but have

payment plus penalty and interest line 7.

to be remitted annually at a minimum. DO NOT SEND

Line 8:

If an overpayment of tax was made on a pre-

W-2G FORMS WITH THIS RETURN.

vious return, enter the amount of the overpay-

Any questions regarding the preparation of this return may

be directed to (303) 238-SERV (7378).

Photo Copy For Your Records

Cut here and send only the coupon below. Help us save time and your tax dollars.

7

DR 1091 Web (06/09/11)

Backup Withholding Tax Return–Gaming

COLORADO DEPARTMENT OF REVENUE

1010-100

Account Number

Period

Due Date

1. Resident income tax withheld

00

Line 14-12G

Social Security Number 1

Social Security Number 2

FEIN

2. Nonresident income tax withheld

00

Line 12-04S

Signed under penalty of perjury in the second degree.

00

(100)

3. Total of lines 1 and 2

Signature

Date

Phone

(

)

00

(200)

4. Penalty

Check here if this is an Amended Return ..

00

(300)

5. Interest

00

6. Total of lines 3, 4 & 5

7. Additional tax, penalty & interest

due for prior periods of current

00

year only.

(900)

8. Overpayment of tax for prior tax

periods of current year to be

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited

00

subtracted from current tax.

(905)

as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected

due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from

9. AMOUNT OWED (line 6 plus line

your bank account electronically.

$

.00

7 or minus line 8)

(355)

(Do not write in space below)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2