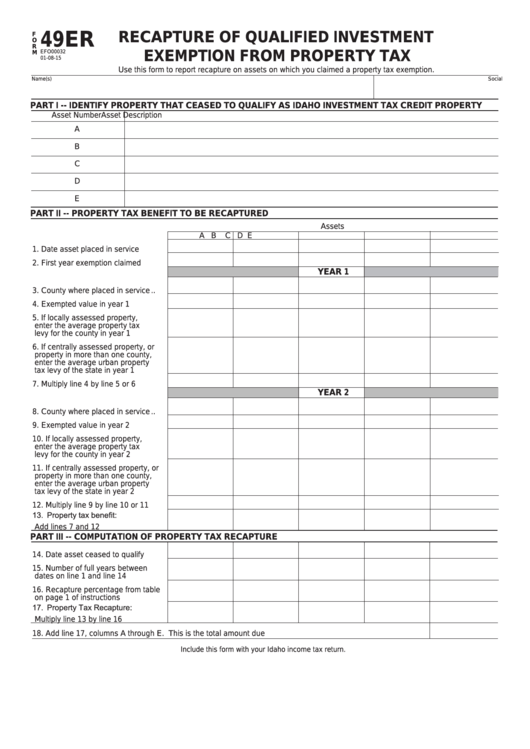

Form 49er - Recapture Of Qualified Investment Exemption From Property Tax

ADVERTISEMENT

49ER

RECAPTURE OF QUALIFIED INVESTMENT

F

O

R

EFO00032

EXEMPTION FROM PROPERTY TAX

M

01-08-15

Use this form to report recapture on assets on which you claimed a property tax exemption.

Name(s)

Social Security Number or EIN

PART I -- IDENTIFY PROPERTY THAT CEASED TO QUALIFY AS IDAHO INVESTMENT TAX CREDIT PROPERTY

Asset Number

Asset Description

A

B

C

D

E

PART II -- PROPERTY TAX BENEFIT TO BE RECAPTURED

Assets

A

B

C

D

E

1. Date asset placed in service .......

2. First year exemption claimed ......

YEAR 1

3. County where placed in service ..

4. Exempted value in year 1 ...........

5. If locally assessed property,

enter the average property tax

levy for the county in year 1 ........

6. If centrally assessed property, or

property in more than one county,

enter the average urban property

tax levy of the state in year 1 ......

7. Multiply line 4 by line 5 or 6 .........

YEAR 2

8. County where placed in service ..

9. Exempted value in year 2 ...........

10. If locally assessed property,

enter the average property tax

levy for the county in year 2 ........

11. If centrally assessed property, or

property in more than one county,

enter the average urban property

tax levy of the state in year 2 ......

12. Multiply line 9 by line 10 or 11 .....

13. Property tax benefit:

Add lines 7 and 12 ....................

PART III -- COMPUTATION OF PROPERTY TAX RECAPTURE

14. Date asset ceased to qualify .......

15. Number of full years between

dates on line 1 and line 14 ..........

16. Recapture percentage from table

on page 1 of instructions .............

17. Property Tax Recapture:

Multiply line 13 by line 16 ............

18. Add line 17, columns A through E. This is the total amount due .........................................................................

Include this form with your Idaho income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3