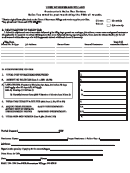

Contractor'S Excise Tax Return Worksheet Page 2

ADVERTISEMENT

14.

14.

4% FUEL USE TAXABLE

Enter the dollar amount of motor fuel used off the road when sales tax was not paid at the time of purchase.

(Report fuel used here only if you DO NOT have a highway contractors license. If you do have a highway

contractors license, report fuel use on your highway contractor license return.)

15.

15.

4% FUEL USE TAX DUE

Multiply Line 14 by 4% (.04).

16.

TOTAL STATE SALES/USE TAX DUE

16.

Add Lines 13 + 15.

17.

TOTAL STATE TAX DUE

17.

Add Lines 11 + 16.

CITY

CITY

NET TXBL

RATE

TAX

CODE

NET TXBL

RATE

TAX

CODE

A.

G .

B.

H.

I.

C.

D.

J.

E.

K.

F.

Total City (Add A thru K) Put total on Line 18.

18.

18. CITY/RESERVATION TAX

City/Reservation taxes must be reported on purchases of construction materials, equipment, office supplies and

services used, stored or consumed within cities or reservations imposing a sales/use tax when sales tax was not

paid at the time of purchase. The individual listing of each city or reservation, its corresponding code and rate,

along with net taxable amount owed for each city or reservation is listed on the original return. Please use the

following space to record this information for your file.

19.

19. TOTAL TAX DUE

Add Lines 17 + 18.

20.

20. INTEREST/PENALTY

Interest: 1.5% (.015) of the tax liability each assessment period (with a minimum $5.00 due). Assessment

periods are each month (or part thereof) OR from one due date to the next due date (or part thereof) on those

returns due on the 20th. Penalty: 10% (.10) of the tax liability (minimum $10.00, even if no tax is due) is

assessed if a return is not received within the next month following the due date.

21. TOTAL DUE

21.

Total amount owing is calculated: Add line 19 to line 20.

22. AMOUNT REMITTED

22.

Enter amount of the remittance attached, make all remittances payable to the South Dakota State Treasurer.

Thank You.

Do not staple or paper clip your check to the return.

Be sure to mail your return and payment in the reversible envelope.

Keep this worksheet with your records.

Both the preparer of the return and the licensee must sign and date the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2