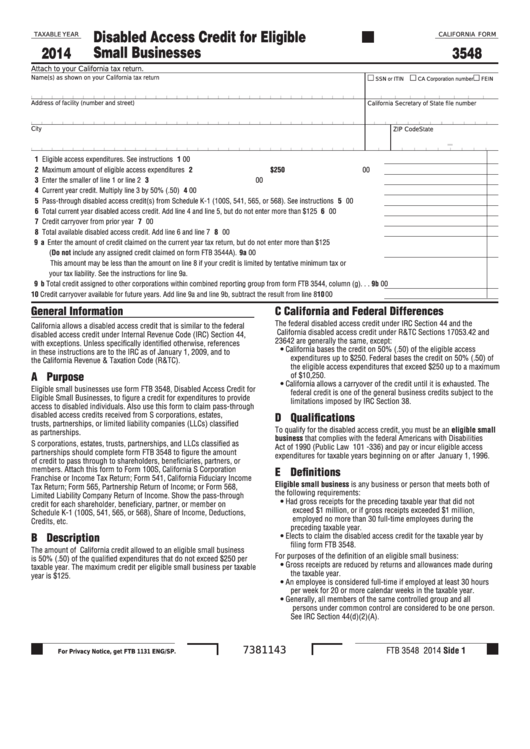

Form 3548 - Disabled Access Credit For Eligible Small Businesses - 2014

ADVERTISEMENT

Disabled Access Credit for Eligible

TAXABLE YEAR

CALIFORNIA FORM

Small Businesses

2014

3548

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation number

FEIN

Address of facility (number and street)

California Secretary of State file number

City

State

ZIP Code

1 Eligible access expenditures. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Maximum amount of eligible access expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

$250

00

3 Enter the smaller of line 1 or line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Current year credit. Multiply line 3 by 50% (.50). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Pass‑through disabled access credit(s) from Schedule K‑1 (100S, 541, 565, or 568). See instructions . . . . . . . . . . 5

00

6 Total current year disabled access credit. Add line 4 and line 5, but do not enter more than $125 . . . . . . . . . . . . . . . 6

00

7 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Total available disabled access credit. Add line 6 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 a Enter the amount of credit claimed on the current year tax return, but do not enter more than $125

(Do not include any assigned credit claimed on form FTB 3544A).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 a

00

This amount may be less than the amount on line 8 if your credit is limited by tentative minimum tax or

your tax liability. See the instructions for line 9a.

9 b Total credit assigned to other corporations within combined reporting group from form FTB 3544, column (g). . .9b

00

10 Credit carryover available for future years. Add line 9a and line 9b, subtract the result from line 8 . . . . . . . . . . . . . .10

00

General Information

C California and Federal Differences

The federal disabled access credit under IRC Section 44 and the

California allows a disabled access credit that is similar to the federal

California disabled access credit under R&TC Sections 17053.42 and

disabled access credit under Internal Revenue Code (IRC) Section 44,

23642 are generally the same, except:

with exceptions. Unless specifically identified otherwise, references

• California bases the credit on 50% (.50) of the eligible access

in these instructions are to the IRC as of January 1, 2009, and to

expenditures up to $250. Federal bases the credit on 50% (.50) of

the California Revenue & Taxation Code (R&TC).

the eligible access expenditures that exceed $250 up to a maximum

A Purpose

of $10,250.

• California allows a carryover of the credit until it is exhausted. The

Eligible small businesses use form FTB 3548, Disabled Access Credit for

federal credit is one of the general business credits subject to the

Eligible Small Businesses, to figure a credit for expenditures to provide

limitations imposed by IRC Section 38.

access to disabled individuals. Also use this form to claim pass‑through

disabled access credits received from S corporations, estates,

D Qualifications

trusts, partnerships, or limited liability companies (LLCs) classified

To qualify for the disabled access credit, you must be an eligible small

as partnerships.

business that complies with the federal Americans with Disabilities

S corporations, estates, trusts, partnerships, and LLCs classified as

Act of 1990 (Public Law 101 ‑336) and pay or incur eligible access

partnerships should complete form FTB 3548 to figure the amount

expenditures for taxable years beginning on or after January 1, 1996.

of credit to pass through to shareholders, beneficiaries, partners, or

E Definitions

members. Attach this form to Form 100S, California S Corporation

Franchise or Income Tax Return; Form 541, California Fiduciary Income

Eligible small business is any business or person that meets both of

Tax Return; Form 565, Partnership Return of Income; or Form 568,

the following requirements:

Limited Liability Company Return of Income. Show the pass‑through

• Had gross receipts for the preceding taxable year that did not

credit for each shareholder, beneficiary, partner, or member on

exceed $1 million, or if gross receipts exceeded $1 million,

Schedule K‑1 (100S, 541, 565, or 568), Share of Income, Deductions,

employed no more than 30 full‑time employees during the

Credits, etc.

preceding taxable year.

B Description

• Elects to claim the disabled access credit for the taxable year by

filing form FTB 3548.

The amount of California credit allowed to an eligible small business

For purposes of the definition of an eligible small business:

is 50% (.50) of the qualified expenditures that do not exceed $250 per

• Gross receipts are reduced by returns and allowances made during

taxable year. The maximum credit per eligible small business per taxable

the taxable year.

year is $125.

• An employee is considered full‑time if employed at least 30 hours

per week for 20 or more calendar weeks in the taxable year.

• Generally, all members of the same controlled group and all

persons under common control are considered to be one person.

See IRC Section 44(d)(2)(A).

FTB 3548 2014 Side 1

7381143

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2