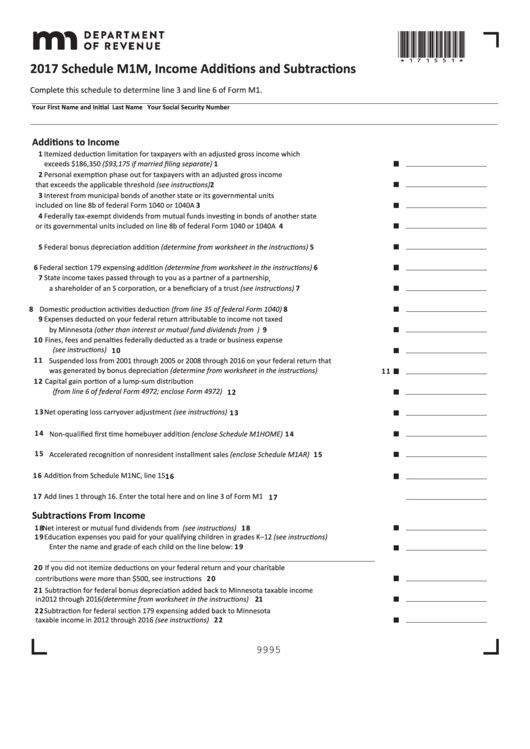

*171551*

2017 Schedule M1M, Income Additions and Subtractions

Complete this schedule to determine line 3 and line 6 of Form M1.

Your First Name and Initial

Last Name

Your Social Security Number

Additions to Income

1 Itemized deduction limitation for taxpayers with an adjusted gross income which

exceeds $186,350 ($93,175 if married filing separate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Personal exemption phase out for taxpayers with an adjusted gross income

that exceeds the applicable threshold (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Interest from municipal bonds of another state or its governmental units

included on line 8b of federal Form 1040 or 1040A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Federally tax-exempt dividends from mutual funds investing in bonds of another state

or its governmental units included on line 8b of federal Form 1040 or 1040A . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Federal bonus depreciation addition (determine from worksheet in the instructions) . . . . . . . . . . . . . . . . . . 5

6 Federal section 179 expensing addition (determine from worksheet in the instructions) . . . . . . . . . . . . . . . . 6

7 State income taxes passed through to you as a partner of a partnership ,

a shareholder of an S corporation, or a beneficiary of a trust (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 7

8 Domestic production activities deduction (from line 35 of federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Expenses deducted on your federal return attributable to income not taxed

by Minnesota (other than interest or mutual fund dividends from U.S. bonds) . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Fines, fees and penalties federally deducted as a trade or business expense

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 0

11 Suspended loss from 2001 through 2005 or 2008 through 2016 on your federal return that

was generated by bonus depreciation (determine from worksheet in the instructions) . . . . . . . . . . . . . . . . . 1 1

12 Capital gain portion of a lump-sum distribution

(from line 6 of federal Form 4972; enclose Form 4972) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2

13 Net operating loss carryover adjustment (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3

14 Non-qualified first time homebuyer addition (enclose Schedule M1HOME) . . . . . . . . . . . . . . . . . . . . . . . . . . 1 4

15 Accelerated recognition of nonresident installment sales (enclose Schedule M1AR) . . . . . . . . . . . . . . . . . . . 1 5

16 Addition from Schedule M1NC, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 6

17 Add lines 1 through 16. Enter the total here and on line 3 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7

Subtractions From Income

18 Net interest or mutual fund dividends from U.S. bonds (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 1 8

19 Education expenses you paid for your qualifying children in grades K–12 (see instructions)

Enter the name and grade of each child on the line below: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 9

20 If you did not itemize deductions on your federal return and your charitable

contributions were more than $500, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 0

21 Subtraction for federal bonus depreciation added back to Minnesota taxable income

in 2012 through 2016 (determine from worksheet in the instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 1

22 Subtraction for federal section 179 expensing added back to Minnesota

taxable income in 2012 through 2016 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 2

9995

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9