*171851*

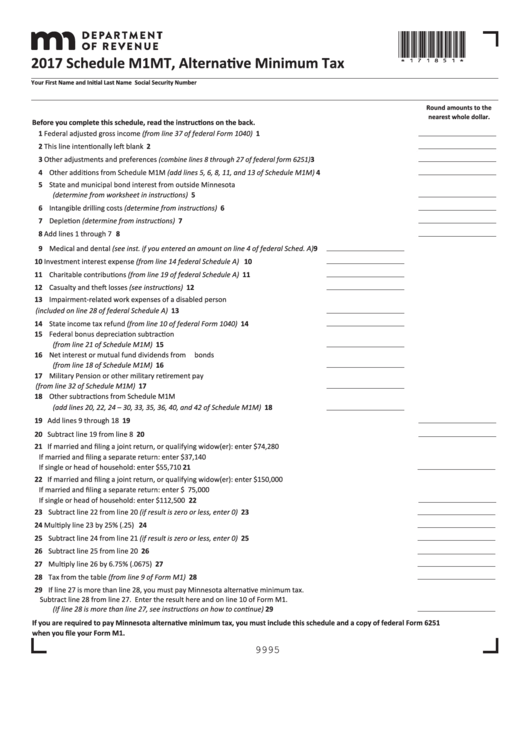

2017 Schedule M1MT, Alternative Minimum Tax

Your First Name and Initial

Last Name

Social Security Number

Round amounts to the

nearest whole dollar.

Before you complete this schedule, read the instructions on the back.

1 Federal adjusted gross income (from line 37 of federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Other adjustments and preferences (combine lines 8 through 27 of federal form 6251) . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Other additions from Schedule M1M (add lines 5, 6, 8, 11, and 13 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . 4

5 State and municipal bond interest from outside Minnesota

(determine from worksheet in instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Intangible drilling costs (determine from instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Depletion (determine from instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 1 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Medical and dental (see inst . if you entered an amount on line 4 of federal Sched . A) 9

10 Investment interest expense (from line 14 federal Schedule A) . . . . . . . . . . . . . . . . 10

11 Charitable contributions (from line 19 of federal Schedule A) . . . . . . . . . . . . . . . . . . 11

12 Casualty and theft losses (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Impairment-related work expenses of a disabled person

(included on line 28 of federal Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 State income tax refund (from line 10 of federal Form 1040) . . . . . . . . . . . . . . . . . . . 14

15 Federal bonus depreciation subtraction

(from line 21 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Net interest or mutual fund dividends from U.S. bonds

(from line 18 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Military Pension or other military retirement pay

(from line 32 of Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Other subtractions from Schedule M1M

(add lines 20, 22, 24 – 30, 33, 35, 36, 40, and 42 of Schedule M1M) . . . . . . . . . . . . . 18

19 Add lines 9 through 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Subtract line 19 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 If married and filing a joint return, or qualifying widow(er):

enter

$74,280

If married and filing a separate return:

enter

$37,140

If single or head of household:

enter

$55,710 . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 If married and filing a joint return, or qualifying widow(er):

enter

$150,000

If married and filing a separate return:

enter

$ 75,000

If single or head of household:

enter

$112,500 . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtract line 22 from line 20 (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Multiply line 23 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Subtract line 24 from line 21 (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Subtract line 25 from line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Multiply line 26 by 6.75% (.0675) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Tax from the table (from line 9 of Form M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 If line 27 is more than line 28, you must pay Minnesota alternative minimum tax.

Subtract line 28 from line 27. Enter the result here and on line 10 of Form M1.

(If line 28 is more than line 27, see instructions on how to continue) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

If you are required to pay Minnesota alternative minimum tax, you must include this schedule and a copy of federal Form 6251

when you file your Form M1.

9995

9995

1

1 2

2