Form 32-024 - Iowa Consumer'S Use Tax Return

ADVERTISEMENT

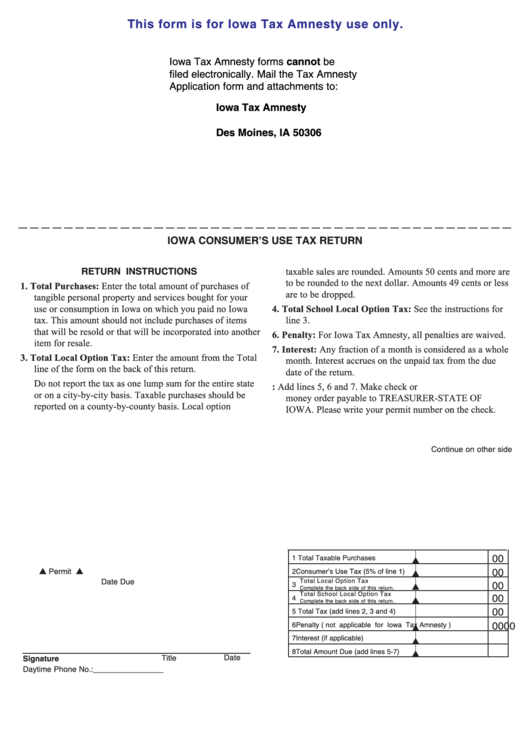

This form is for Iowa Tax Amnesty use only.

Iowa Tax Amnesty forms cannot be

filed electronically. Mail the Tax Amnesty

Application form and attachments to:

Iowa Tax Amnesty

P.O. Box 1792

Des Moines, IA 50306

IOWA CONSUMER’S USE TAX RETURN

RETURN INSTRUCTIONS

taxable sales are rounded. Amounts 50 cents and more are

to be rounded to the next dollar. Amounts 49 cents or less

1. Total Purchases: Enter the total amount of purchases of

are to be dropped.

tangible personal property and services bought for your

use or consumption in Iowa on which you paid no Iowa

4. Total School Local Option Tax: See the instructions for

tax. This amount should not include purchases of items

line 3.

that will be resold or that will be incorporated into another

6. Penalty: For Iowa Tax Amnesty, all penalties are waived.

item for resale.

7. Interest: Any fraction of a month is considered as a whole

3. Total Local Option Tax: Enter the amount from the Total

month. Interest accrues on the unpaid tax from the due

line of the form on the back of this return.

date of the return.

Do not report the tax as one lump sum for the entire state

8. Total Amount Due: Add lines 5, 6 and 7. Make check or

or on a city-by-city basis. Taxable purchases should be

money order payable to TREASURER-STATE OF

reported on a county-by-county basis. Local option

IOWA. Please write your permit number on the check.

Continue on other side

00

1 Total Taxable Purchases

Permit No.

Period

00

2 Consumer’s Use Tax (5% of line 1)

Date Due

Total Local Option Tax

00

3

Complete the back side of this return.

Total School Local Option Tax

00

4

Complete the back side of this return.

00

5 Total Tax (add lines 2, 3 and 4)

00

00

6 Penalty ( not applicable for Iowa Tax Amnesty )

7 Interest (if applicable)

8 Total Amount Due (add lines 5-7)

Date

Title

Signature

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2