SD EForm - 2121

V1

HELP

Complete and use the buttons at the end to send electronically or to print for mailing.

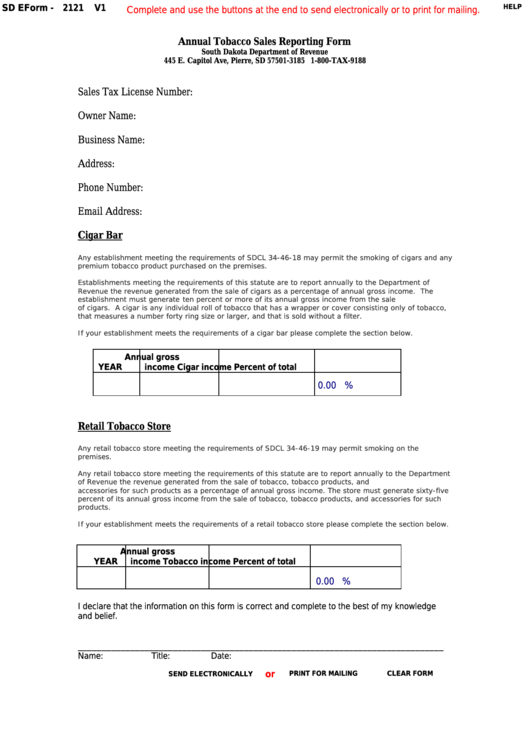

Annual Tobacco Sales Reporting Form

South Dakota Department of Revenue

445 E. Capitol Ave, Pierre, SD 57501-3185 1-800-TAX-9188

Sales Tax License Number:

Owner Name:

Business Name:

Address:

Phone Number:

Email Address:

Cigar Bar

Any establishment meeting the requirements of SDCL 34-46-18 may permit the smoking of cigars and any

premium tobacco product purchased on the premises.

Establishments meeting the requirements of this statute are to report annually to the Department of

Revenue the revenue generated from the sale of cigars as a percentage of annual gross income. The

establishment must generate ten percent or more of its annual gross income from the sale

of cigars. A cigar is any individual roll of tobacco that has a wrapper or cover consisting only of tobacco,

that measures a number forty ring size or larger, and that is sold without a filter.

If your establishment meets the requirements of a cigar bar please complete the section below.

Annual gross

YEAR

income

Cigar income

Percent of total

0.00 %

Retail Tobacco Store

Any retail tobacco store meeting the requirements of SDCL 34-46-19 may permit smoking on the

premises.

Any retail tobacco store meeting the requirements of this statute are to report annually to the Department

of Revenue the revenue generated from the sale of tobacco, tobacco products, and

accessories for such products as a percentage of annual gross income. The store must generate sixty-five

percent of its annual gross income from the sale of tobacco, tobacco products, and accessories for such

products.

If your establishment meets the requirements of a retail tobacco store please complete the section below.

Annual gross

YEAR

income

Tobacco income

Percent of total

0.00 %

I declare that the information on this form is correct and complete to the best of my knowledge

and belief.

_____________________________________________________________________________

Name:

Title:

Date:

or

PRINT FOR MAILING

CLEAR FORM

SEND ELECTRONICALLY

1

1