Staple forms here

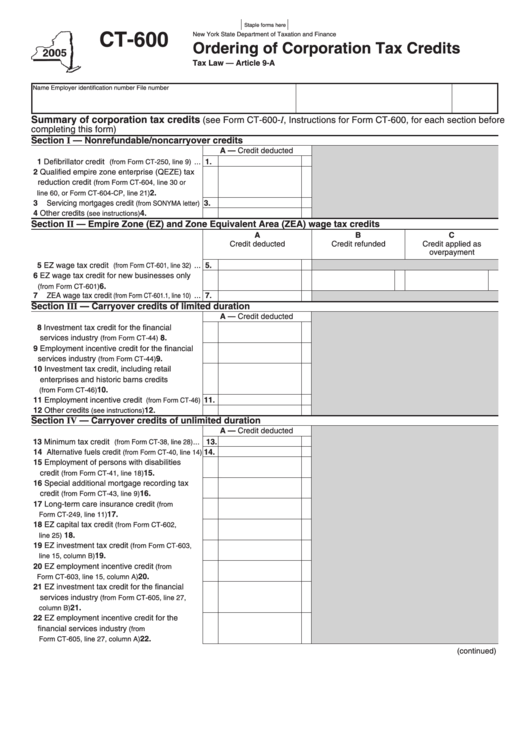

CT-600

New York State Department of Taxation and Finance

Ordering of Corporation Tax Credits

Tax Law — Article 9-A

Name

Employer identification number

File number

Summary of corporation tax credits

(see Form CT-600- I , Instructions for Form CT-600, for each section before

completing this form)

Section I — Nonrefundable/noncarryover credits

A — Credit deducted

1 Defibrillator credit

...

1.

(from Form CT-250, line 9)

2 Qualified empire zone enterprise (QEZE) tax

reduction credit

(from Form CT-604, line 30 or

2.

...............

line 60, or Form CT-604-CP, line 21)

3 Servicing mortgages credit

3.

(from SONYMA letter)

4 Other credits

4.

.......................

(see instructions)

Section II — Empire Zone (EZ) and Zone Equivalent Area (ZEA) wage tax credits

A

B

C

Credit deducted

Credit refunded

Credit applied as

overpayment

5 EZ wage tax credit

5.

...

(from Form CT-601, line 32)

6 EZ wage tax credit for new businesses only

.....................................

6.

(from Form CT-601)

7 ZEA wage tax credit

...

7.

(from Form CT-601.1, line 10)

Section III — Carryover credits of limited duration

A — Credit deducted

8 Investment tax credit for the financial

services industry

...........

8.

(from Form CT-44)

9 Employment incentive credit for the financial

9.

services industry

...........

(from Form CT-44)

10 Investment tax credit, including retail

enterprises and historic barns credits

....................................... 10.

(from Form CT-46)

11 Employment incentive credit

11.

(from Form CT-46)

12 Other credits

....................... 12.

(see instructions)

Section IV — Carryover credits of unlimited duration

A — Credit deducted

13 Minimum tax credit

... 13.

(from Form CT-38, line 28)

14 Alternative fuels credit

14.

(from Form CT-40, line 14)

15 Employment of persons with disabilities

.................. 15.

credit

(from Form CT-41, line 18)

16 Special additional mortgage recording tax

.................... 16.

credit

(from Form CT-43, line 9)

17 Long-term care insurance credit

(from

................................... 17.

Form CT-249, line 11)

18 EZ capital tax credit

(from Form CT-602,

....................................................... 18.

line 25)

19 EZ investment tax credit

(from Form CT-603,

........................................ 19.

line 15, column B)

20 EZ employment incentive credit

(from

.................... 20.

Form CT-603, line 15, column A)

21 EZ investment tax credit for the financial

services industry

(from Form CT-605, line 27,

................................................... 21.

column B)

22 EZ employment incentive credit for the

financial services industry

(from

.................... 22.

Form CT-605, line 27, column A)

(continued)

1

1 2

2