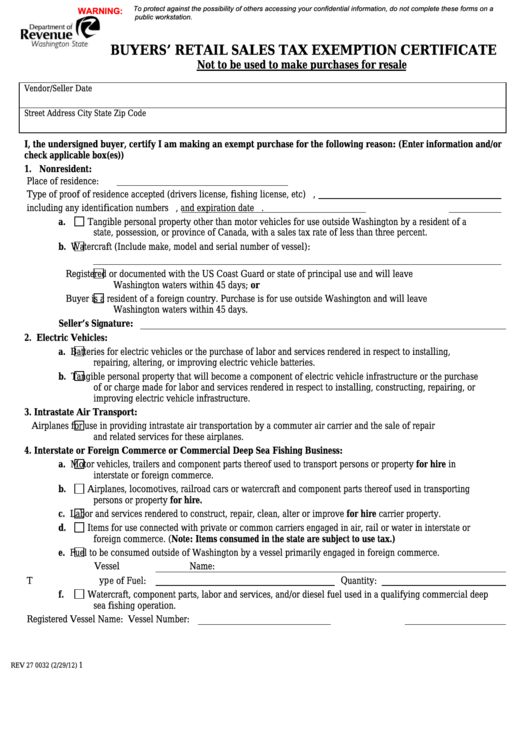

To protect against the possibility of others accessing your confidential information, do not complete these forms on a

WARNING:

public workstation.

BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE

Not to be used to make purchases for resale

Vendor/Seller

Date

Street Address

City

State

Zip Code

I, the undersigned buyer, certify I am making an exempt purchase for the following reason: (Enter information and/or

check applicable box(es))

1. Nonresident:

Place of residence:

Type of proof of residence accepted (drivers license, fishing license, etc)

,

including any identification numbers

, and expiration date

.

a.

Tangible personal property other than motor vehicles for use outside Washington by a resident of a

state, possession, or province of Canada, with a sales tax rate of less than three percent.

b.

Watercraft (Include make, model and serial number of vessel):

Registered or documented with the US Coast Guard or state of principal use and will leave

Washington waters within 45 days; or

Buyer is a resident of a foreign country. Purchase is for use outside Washington and will leave

Washington waters within 45 days.

Seller’s Signature:

2. Electric Vehicles:

a.

Batteries for electric vehicles or the purchase of labor and services rendered in respect to installing,

repairing, altering, or improving electric vehicle batteries.

b.

Tangible personal property that will become a component of electric vehicle infrastructure or the purchase

of or charge made for labor and services rendered in respect to installing, constructing, repairing, or

improving electric vehicle infrastructure.

3. Intrastate Air Transport:

Airplanes for use in providing intrastate air transportation by a commuter air carrier and the sale of repair

and related services for these airplanes.

4. Interstate or Foreign Commerce or Commercial Deep Sea Fishing Business:

a.

Motor vehicles, trailers and component parts thereof used to transport persons or property for hire in

interstate or foreign commerce.

b.

Airplanes, locomotives, railroad cars or watercraft and component parts thereof used in transporting

persons or property for hire.

c.

Labor and services rendered to construct, repair, clean, alter or improve for hire carrier property.

d.

Items for use connected with private or common carriers engaged in air, rail or water in interstate or

foreign commerce. (Note: Items consumed in the state are subject to use tax.)

e.

Fuel to be consumed outside of Washington by a vessel primarily engaged in foreign commerce.

Vessel Name:

Type of Fuel:

Quantity:

f.

Watercraft, component parts, labor and services, and/or diesel fuel used in a qualifying commercial deep

sea fishing operation.

Registered Vessel Name:

Vessel Number:

1

Next Page

REV 27 0032

(2/29/12)

1

1 2

2 3

3 4

4 5

5 6

6