Print Form

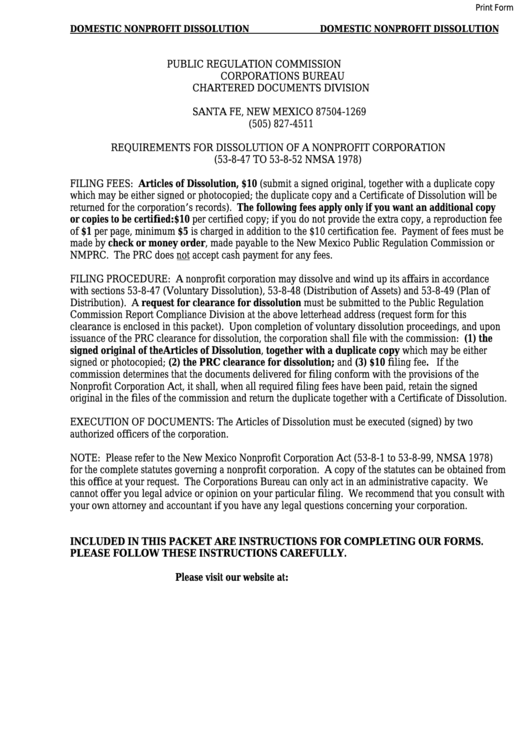

DOMESTIC NONPROFIT DISSOLUTION

DOMESTIC NONPROFIT DISSOLUTION

PUBLIC REGULATION COMMISSION

CORPORATIONS BUREAU

CHARTERED DOCUMENTS DIVISION

P.O. BOX 1269

SANTA FE, NEW MEXICO 87504-1269

(505) 827-4511

REQUIREMENTS FOR DISSOLUTION OF A NONPROFIT CORPORATION

(53-8-47 TO 53-8-52 NMSA 1978)

FILING FEES: Articles of Dissolution, $10 (submit a signed original, together with a duplicate copy

which may be either signed or photocopied; the duplicate copy and a Certificate of Dissolution will be

returned for the corporation’s records). The following fees apply only if you want an additional copy

or copies to be certified: $10 per certified copy; if you do not provide the extra copy, a reproduction fee

of $1 per page, minimum $5 is charged in addition to the $10 certification fee. Payment of fees must be

made by check or money order, made payable to the New Mexico Public Regulation Commission or

NMPRC. The PRC does not accept cash payment for any fees.

FILING PROCEDURE: A nonprofit corporation may dissolve and wind up its affairs in accordance

with sections 53-8-47 (Voluntary Dissolution), 53-8-48 (Distribution of Assets) and 53-8-49 (Plan of

Distribution). A request for clearance for dissolution must be submitted to the Public Regulation

Commission Report Compliance Division at the above letterhead address (request form for this

clearance is enclosed in this packet). Upon completion of voluntary dissolution proceedings, and upon

issuance of the PRC clearance for dissolution, the corporation shall file with the commission: (1) the

signed original of the Articles of Dissolution, together with a duplicate copy which may be either

signed or photocopied; (2) the PRC clearance for dissolution; and (3) $10 filing fee. If the

commission determines that the documents delivered for filing conform with the provisions of the

Nonprofit Corporation Act, it shall, when all required filing fees have been paid, retain the signed

original in the files of the commission and return the duplicate together with a Certificate of Dissolution.

EXECUTION OF DOCUMENTS: The Articles of Dissolution must be executed (signed) by two

authorized officers of the corporation.

NOTE: Please refer to the New Mexico Nonprofit Corporation Act (53-8-1 to 53-8-99, NMSA 1978)

for the complete statutes governing a nonprofit corporation. A copy of the statutes can be obtained from

this office at your request. The Corporations Bureau can only act in an administrative capacity. We

cannot offer you legal advice or opinion on your particular filing. We recommend that you consult with

your own attorney and accountant if you have any legal questions concerning your corporation.

INCLUDED IN THIS PACKET ARE INSTRUCTIONS FOR COMPLETING OUR FORMS.

PLEASE FOLLOW THESE INSTRUCTIONS CAREFULLY.

Please visit our website at:

1

1 2

2 3

3 4

4