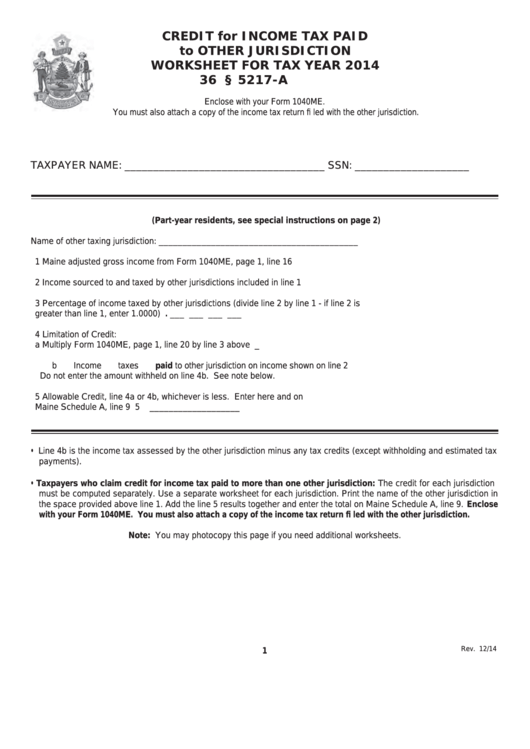

CREDIT for INCOME TAX PAID

to OTHER JURISDICTION

WORKSHEET FOR TAX YEAR 2014

36 M.R.S. § 5217-A

Enclose with your Form 1040ME.

You must also attach a copy of the income tax return fi led with the other jurisdiction.

TAXPAYER NAME: ___________________________________

SSN: ____________________

(Part-year residents, see special instructions on page 2)

Name of other taxing jurisdiction: __________________________________________

1

Maine adjusted gross income from Form 1040ME, page 1, line 16 .................................... 1 ___________________

2

Income sourced to and taxed by other jurisdictions included in line 1 ................................ 2 ____________________

3

Percentage of income taxed by other jurisdictions (divide line 2 by line 1 - if line 2 is

greater than line 1, enter 1.0000) ........................................................................................ 3 __ . ___ ___ ___ ___

4

Limitation of Credit:

a Multiply Form 1040ME, page 1, line 20 by line 3 above .................................................4a ___________________

b Income taxes paid to other jurisdiction on income shown on line 2 .................................4b ___________________

Do not enter the amount withheld on line 4b. See note below.

5

Allowable Credit, line 4a or 4b, whichever is less. Enter here and on

Maine Schedule A, line 9 .................................................................................................... 5 ___________________

• Line 4b is the income tax assessed by the other jurisdiction minus any tax credits (except withholding and estimated tax

payments).

• Taxpayers who claim credit for income tax paid to more than one other jurisdiction: The credit for each jurisdiction

must be computed separately. Use a separate worksheet for each jurisdiction. Print the name of the other jurisdiction in

the space provided above line 1. Add the line 5 results together and enter the total on Maine Schedule A, line 9. Enclose

with your Form 1040ME. You must also attach a copy of the income tax return fi led with the other jurisdiction.

Note: You may photocopy this page if you need additional worksheets.

Rev. 12/14

1

1

1 2

2