TC-535_1.ai

Rev. 3/05

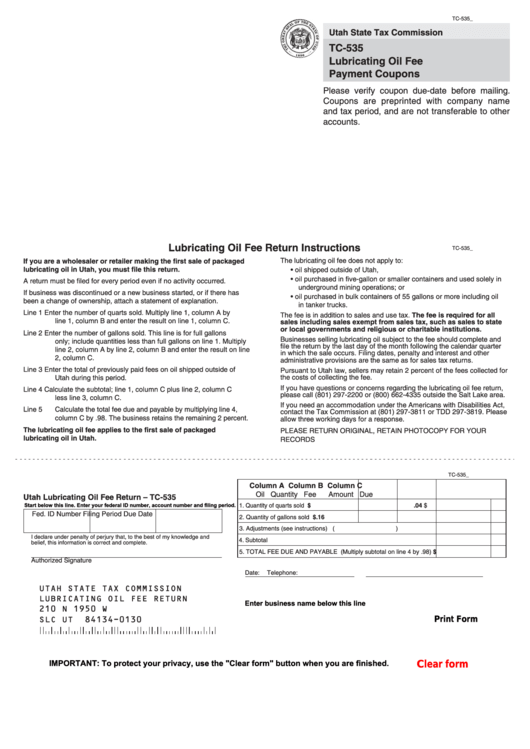

Utah State Tax Commission

TC-535

Lubricating Oil Fee

Payment Coupons

Please verify coupon due-date before mailing.

Coupons are preprinted with company name

and tax period, and are not transferable to other

accounts.

Lubricating Oil Fee Return Instructions

TC-535_2.ai

Rev. 3/05

If you are a wholesaler or retailer making the first sale of packaged

The lubricating oil fee does not apply to:

lubricating oil in Utah, you must file this return.

• oil shipped outside of Utah,

• oil purchased in five-gallon or smaller containers and used solely in

A return must be filed for every period even if no activity occurred.

underground mining operations; or

If business was discontinued or a new business started, or if there has

• oil purchased in bulk containers of 55 gallons or more including oil

been a change of ownership, attach a statement of explanation.

in tanker trucks.

Line 1

Enter the number of quarts sold. Multiply line 1, column A by

The fee is in addition to sales and use tax. The fee is required for all

line 1, column B and enter the result on line 1, column C.

sales including sales exempt from sales tax, such as sales to state

or local governments and religious or charitable institutions.

Line 2

Enter the number of gallons sold. This line is for full gallons

Businesses selling lubricating oil subject to the fee should complete and

only; include quantities less than full gallons on line 1. Multiply

file the return by the last day of the month following the calendar quarter

line 2, column A by line 2, column B and enter the result on line

in which the sale occurs. Filing dates, penalty and interest and other

2, column C.

administrative provisions are the same as for sales tax returns.

Line 3

Enter the total of previously paid fees on oil shipped outside of

Pursuant to Utah law, sellers may retain 2 percent of the fees collected for

the costs of collecting the fee.

Utah during this period.

If you have questions or concerns regarding the lubricating oil fee return,

Line 4

Calculate the subtotal; line 1, column C plus line 2, column C

please call (801) 297-2200 or (800) 662-4335 outside the Salt Lake area.

less line 3, column C.

If you need an accommodation under the Americans with Disabilities Act,

Line 5

Calculate the total fee due and payable by multiplying line 4,

contact the Tax Commission at (801) 297-3811 or TDD 297-3819. Please

column C by .98. The business retains the remaining 2 percent.

allow three working days for a response.

The lubricating oil fee applies to the first sale of packaged

PLEASE RETURN ORIGINAL, RETAIN PHOTOCOPY FOR YOUR

lubricating oil in Utah.

RECORDS

TC-535_3.ai

Rev. 3/05

Column A Column B

Column C

Oil

Quantity

Fee

Amount Due

Utah Lubricating Oil Fee Return – TC-535

Start below this line. Enter your federal ID number, account number and filing period.

1. Quantity of quarts sold

$.04

$

Fed. ID Number

Filing Period

Due Date

2. Quantity of gallons sold

$.16

3. Adjustments (see instructions)

(

)

I declare under penalty of perjury that, to the best of my knowledge and

4. Subtotal

belief, this information is correct and complete.

5. TOTAL FEE DUE AND PAYABLE (Multiply subtotal on line 4 by .98)

$

Authorized Signature

Date:

Telephone:

UTAH STATE TAX COMMISSION

LUBRICATING OIL FEE RETURN

Enter business name below this line

210 N 1950 W

SLC UT

84134-0130

Print Form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1