Schedule M1cd - Child And Dependent Care Credit - 2017

ADVERTISEMENT

*171772*

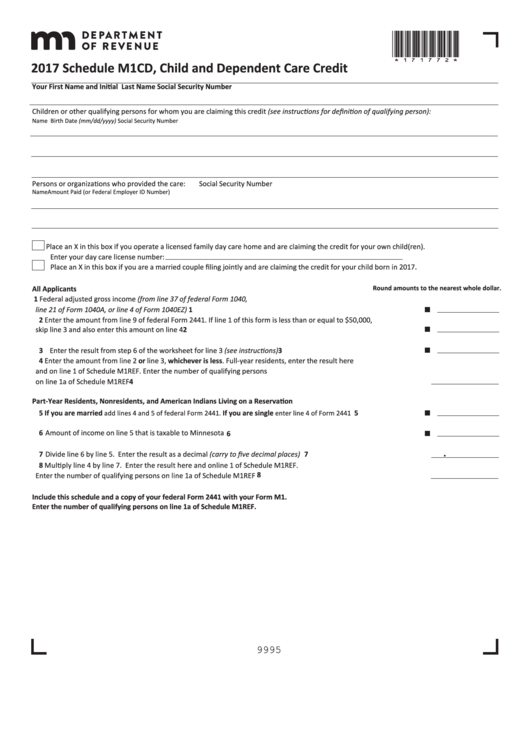

2017 Schedule M1CD, Child and Dependent Care Credit

Your First Name and Initial

Last Name

Social Security Number

Children or other qualifying persons for whom you are claiming this credit (see instructions for definition of qualifying person):

Name

Birth Date (mm/dd/yyyy)

Social Security Number

Persons or organizations who provided the care:

Social Security Number

Name

Amount Paid

(or Federal Employer ID Number)

Place an X in this box if you operate a licensed family day care home and are claiming the credit for your own child(ren).

Enter your day care license number:

.

Place an X in this box if you are a married couple filing jointly and are claiming the credit for your child born in 2017

Round amounts to the nearest whole dollar.

All Applicants

1 Federal adjusted gross income (from line 37 of federal Form 1040,

line 21 of Form 1040A, or line 4 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Enter the amount from line 9 of federal Form 2441. If line 1 of this form is less than or equal to $50,000,

skip line 3 and also enter this amount on line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Enter the result from step 6 of the worksheet for line 3 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter the amount from line 2 or line 3, whichever is less. Full-year residents, enter the result here

and on line 1 of Schedule M1REF. Enter the number of qualifying persons

on line 1a of Schedule M1REF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Part-Year Residents, Nonresidents, and American Indians Living on a Reservation

5 If you are married

If you are single

. . . . . . . . . . . . . . . 5

add lines 4 and 5 of federal Form 2441.

enter line 4 of Form 2441

6 Amount of income on line 5 that is taxable to Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

7 Divide line 6 by line 5. Enter the result as a decimal (carry to five decimal places) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Multiply line 4 by line 7. Enter the result here and on line 1 of Schedule M1REF.

Enter the number of qualifying persons on line 1a of Schedule M1REF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Include this schedule and a copy of your federal Form 2441 with your Form M1.

Enter the number of qualifying persons on line 1a of Schedule M1REF.

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3