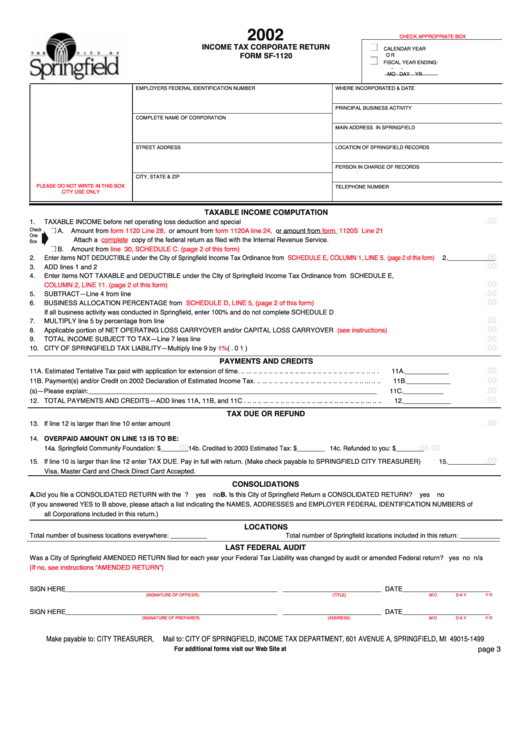

Form Sf-1120 - Income Tax Corporate Return - 2002

ADVERTISEMENT

2002

CHECK APPROPRIATE BOX

INCOME TAX CORPORATE RETURN

CALENDAR YEAR

FORM SF-1120

OR

FISCAL YEAR ENDING:

-

-

MO

DAY

YR

EMPLOYERS FEDERAL IDENTIFICATION NUMBER

WHERE INCORPORATED & DATE

PRINCIPAL BUSINESS ACTIVITY

COMPLETE NAME OF CORPORATION

MAIN ADDRESS IN SPRINGFIELD

STREET ADDRESS

LOCATION OF SPRINGFIELD RECORDS

PERSON IN CHARGE OF RECORDS

CITY, STATE & ZIP

PLEASE DO NOT WRITE IN THIS BOX

TELEPHONE NUMBER

CITY USE ONLY

TAXABLE INCOME COMPUTATION

. 00

1.

TAXABLE INCOME before net operating loss deduction and special deductions ...................................................................................

1. _____________

Check

A.

Amount from

form 1120 Line 28,

or amount from

form 1120A line 24,

or amount from

form 1120S Line 21

One

Attach a

complete

copy of the federal return as filed with the Internal Revenue Service.

Box

B.

Amount from

line 30, SCHEDULE C. (page 2 of this form)

. 00

2.

Enter items NOT DEDUCTIBLE under the City of Springfield Income Tax Ordinance from

SCHEDULE E, COLUMN 1, LINE 5. (page 2 of this form)

2. _____________

. 00

3.

ADD lines 1 and 2 ....................................................................................................................................................................................

3. _____________

4.

Enter items NOT TAXABLE and DEDUCTIBLE under the City of Springfield Income Tax Ordinance from SCHEDULE E,

. 00

COLUMN 2, LINE 11. (page 2 of this

form)..............................................................................................................................................

4. _____________

. 00

5.

SUBTRACT—Line 4 from line 3...............................................................................................................................................................

5. _____________

. 00

6.

BUSINESS ALLOCATION PERCENTAGE from

SCHEDULE D, LINE 5, (page 2 of this form)

.............................................................

6. _____________

If all business activity was conducted in Springfield, enter 100% and do not complete SCHEDULE D

. 00

7.

MULTIPLY line 5 by percentage from line 6 .............................................................................................................................................

7. _____________

. 00

8.

Applicable portion of NET OPERATING LOSS CARRYOVER and/or CAPITAL LOSS CARRYOVER

(see instructions)

.....................

8. _____________

. 00

9.

TOTAL INCOME SUBJECT TO TAX—Line 7 less line 8..........................................................................................................................

9. _____________

. 00

10. CITY OF SPRINGFIELD TAX LIABILITY—Multiply line 9 by

1%

(.01) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10._____________

PAYMENTS AND CREDITS

. 00

11A. Estimated Tentative Tax paid with application for extension of time . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11A.____________

. 00

11B. Payment(s) and/or Credit on 2002 Declaration of Estimated Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11B.____________

. 00

11C. Other Credit(s)—Please explain:_______________________________________________________________________________

11C. ___________

. 00

12. TOTAL PAYMENTS AND CREDITS—ADD lines 11A, 11B, and 11C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12._____________

TAX DUE OR REFUND

. 00

13. If line 12 is larger than line 10 enter amount OVERPAID.........................................................................................................................

13._____________

14. OVERPAID AMOUNT ON LINE 13 IS TO BE:

.00

. 00

. 00

14a. Springfield Community Foundation: $________ 14b. Credited to 2003 Estimated Tax: $________ 14c. Refunded to you: $________

. 00

15. If line 10 is larger than line 12 enter TAX DUE. Pay in full with return. (Make check payable to SPRINGFIELD CITY TREASURER)

15._____________

Visa, Master Card and Check Direct Card Accepted.

CONSOLIDATIONS

A.

Did you file a CONSOLIDATED RETURN with the I.R.S.?

yes

no

B. Is this City of Springfield Return a CONSOLIDATED RETURN?

yes

no

(If you answered YES to B above, please attach a list indicating the NAMES, ADDRESSES and EMPLOYER FEDERAL IDENTIFICATION NUMBERS of

all Corporations included in this return.)

LOCATIONS

Total number of business locations everywhere: __________

Total number of Springfield locations included in this return: ___________

LAST FEDERAL AUDIT

Was a City of Springfield AMENDED RETURN filed for each year your Federal Tax Liability was changed by audit or amended Federal return?

yes no n/a

(If no, see instructions “AMENDED RETURN”)

SIGN HERE__________________________________________________________

___________________________ DATE________________________

(SIGNATURE OF OFFICER)

(TITLE)

MO

DAY

YR

SIGN HERE__________________________________________________________

___________________________ DATE________________________

(SIGNATURE OF PREPARER)

(ADDRESS)

MO

DAY

YR

Make payable to: CITY TREASURER,

Mail to: CITY OF SPRINGFIELD, INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

For additional forms visit our Web Site at

page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2