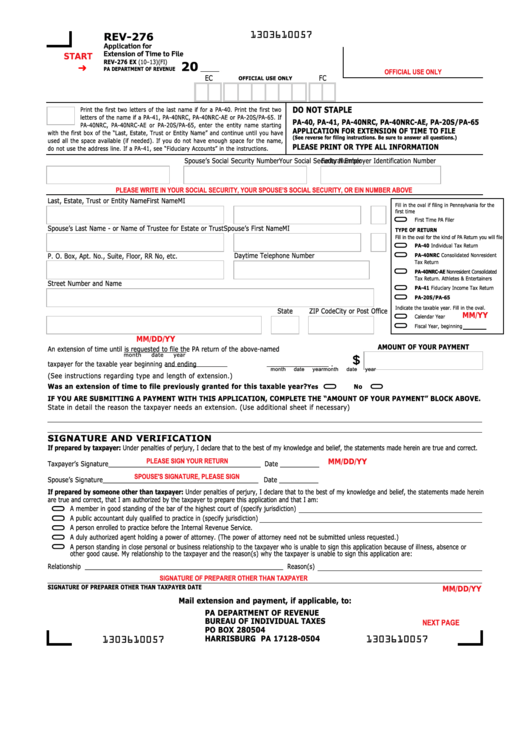

1303610057

REV-276

Application for

Extension of Time to File

START

REV-276 EX (10–13)(FI)

2003

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

EC

FC

OFFICIAL USE ONLY

DO NOT STAPLE

Print the first two letters of the last name if for a PA-40. Print the first two

letters of the name if a PA-41, PA-40NRC, PA-40NRC-AE or PA-20S/PA-65. If

PA-40, PA-41, PA-40NRC, PA-40NRC-AE, PA-20S/PA-65

PA-40NRC, PA-40NRC-AE or PA-20S/PA-65, enter the entity name starting

APPLICATION FOR EXTENSION OF TIME TO FILE

with the first box of the “Last, Estate, Trust or Entity Name” and continue until you have

(See reverse for filing instructions. Be sure to answer all questions.)

used all the space available (if needed). If you do not have enough space for the name,

PLEASE PRINT OR TYPE ALL INFORMATION

do not use the address line. If a PA-41, see “Fiduciary Accounts” in the instructions.

Your Social Security Number

Spouse’s Social Security Number

Federal Employer Identification Number

PLEASE WRITE IN YOUR SOCIAL SECURITY, YOUR SPOUSE’S SOCIAL SECURITY, OR EIN NUMBER ABOVE

Last, Estate, Trust or Entity Name

First Name

MI

Fill in the oval if filing in Pennsylvania for the

first time

First Time PA Filer

Spouse’s Last Name - or Name of Trustee for Estate or Trust

Spouse’s First Name

MI

TYPE OF RETURN

Fill in the oval for the kind of PA Return you will file

PA-40 Individual Tax Return

P. O. Box, Apt. No., Suite, Floor, RR No, etc.

Daytime Telephone Number

PA-40NRC Consolidated Nonresident

Tax Return

PA-40NRC-AE Nonresident Consolidated

Tax Return. Athletes & Entertainers

Street Number and Name

PA-41 Fiduciary Income Tax Return

PA-20S/PA-65

Indicate the taxable year. Fill in the oval.

City or Post Office

State

ZIP Code

MM/YY

Calendar Year

Fiscal Year, beginning

MM/DD/YY

AMOUNT OF YOUR PAYMENT

An extension of time until

is requested to file the PA return of the above-named

month

date

year

$

taxpayer for the taxable year beginning

and ending

.

month

date

year

month

date

year

(See instructions regarding type and length of extension.)

Was an extension of time to file previously granted for this taxable year?

Yes

No

IF YOU ARE SUBMITTING A PAYMENT WITH THIS APPLICATION, COMPLETE THE “AMOUNT OF YOUR PAYMENT” BLOCK ABOVE.

State in detail the reason the taxpayer needs an extension. (Use additional sheet if necessary)

SIGNATURE AND VERIFICATION

If prepared by taxpayer: Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

PLEASE SIGN YOUR RETURN

MM/DD/YY

Taxpayer’s Signature _______________________________________________ Date ____________

SPOUSE'S SIGNATURE, PLEASE SIGN

Spouse’s Signature ________________________________________________ Date ____________

If prepared by someone other than taxpayer: Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein

are true and correct, that I am authorized by the taxpayer to prepare this application and that I am:

A member in good standing of the bar of the highest court of (specify jurisdiction)

A public accountant duly qualified to practice in (specify jurisdiction)

A person enrolled to practice before the Internal Revenue Service.

A duly authorized agent holding a power of attorney. (The power of attorney need not be submitted unless requested.)

A person standing in close personal or business relationship to the taxpayer who is unable to sign this application because of illness, absence or

other good cause. My relationship to the taxpayer and the reason(s) why the taxpayer is unable to sign this application are:

Relationship __________________________________________________________ Reason(s)

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

DATE

MM/DD/YY

Mail extension and payment, if applicable, to:

PRINT FORM

PA DEPARTMENT OF REVENUE

Reset Entire Form

NEXT PAGE

BUREAU OF INDIVIDUAL TAXES

PO BOX 280504

HARRISBURG PA 17128-0504

1303610057

1303610057

1

1 2

2