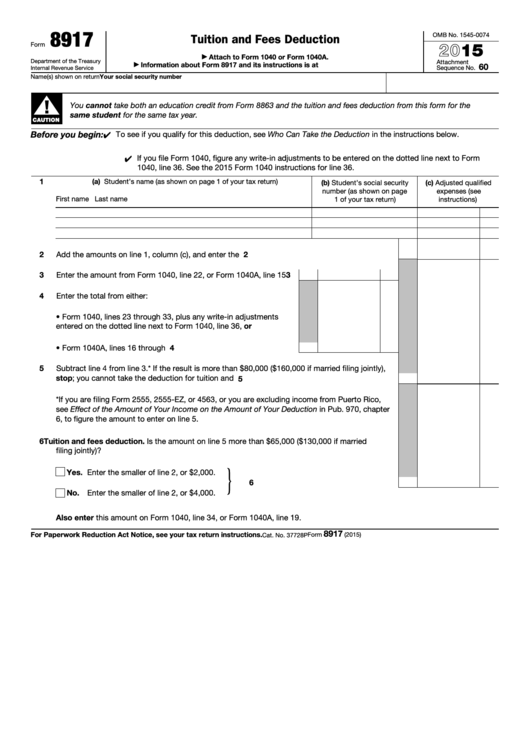

8917

OMB No. 1545-0074

Tuition and Fees Deduction

2015

Form

Attach to Form 1040 or Form 1040A.

▶

Department of the Treasury

Attachment

Information about Form 8917 and its instructions is at

60

▶

Internal Revenue Service

Sequence No.

Name(s) shown on return

Your social security number

▲

!

You cannot take both an education credit from Form 8863 and the tuition and fees deduction from this form for the

same student for the same tax year.

CAUTION

Before you begin:

To see if you qualify for this deduction, see Who Can Take the Deduction in the instructions below.

✔

If you file Form 1040, figure any write-in adjustments to be entered on the dotted line next to Form

✔

1040, line 36. See the 2015 Form 1040 instructions for line 36.

1

(a) Student’s name (as shown on page 1 of your tax return)

(b) Student’s social security

(c) Adjusted qualified

number (as shown on page

expenses (see

First name

Last name

1 of your tax return)

instructions)

2

2

Add the amounts on line 1, column (c), and enter the total .

.

.

.

.

.

.

.

.

.

.

.

.

3

Enter the amount from Form 1040, line 22, or Form 1040A, line 15

3

4

Enter the total from either:

• Form 1040, lines 23 through 33, plus any write-in adjustments

entered on the dotted line next to Form 1040, line 36, or

• Form 1040A, lines 16 through 18.

.

.

.

.

.

.

.

.

.

.

4

5

Subtract line 4 from line 3.* If the result is more than $80,000 ($160,000 if married filing jointly),

stop; you cannot take the deduction for tuition and fees

.

.

.

.

.

.

.

.

.

.

.

.

.

5

*If you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from Puerto Rico,

see Effect of the Amount of Your Income on the Amount of Your Deduction in Pub. 970, chapter

6, to figure the amount to enter on line 5.

6

Tuition and fees deduction. Is the amount on line 5 more than $65,000 ($130,000 if married

filing jointly)?

}

Yes. Enter the smaller of line 2, or $2,000.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

No. Enter the smaller of line 2, or $4,000.

Also enter this amount on Form 1040, line 34, or Form 1040A, line 19.

8917

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2015)

Cat. No. 37728P

1

1 2

2 3

3