Form Cm-2 - Hawaii Statement Of Financial Condition And Other Information

ADVERTISEMENT

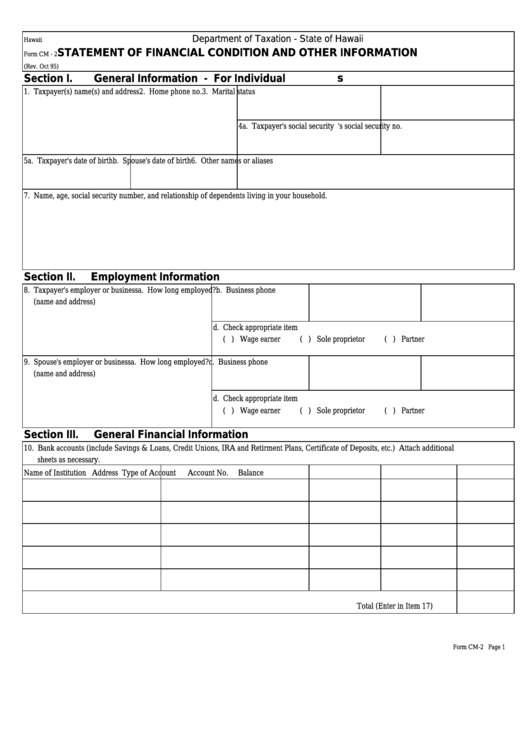

Department of Taxation - State of Hawaii

Hawaii

STATEMENT OF FINANCIAL CONDITION AND OTHER INFORMATION

Form CM - 2

(Rev. Oct 95)

Section I.

General Information - For Individuals

1. Taxpayer(s) name(s) and address

2. Home phone no.

3. Marital status

4a. Taxpayer's social security no.

b. Spouse's social security no.

5a. Taxpayer's date of birth

b. Spouse's date of birth

6. Other names or aliases

7. Name, age, social security number, and relationship of dependents living in your household.

Section II.

Employment Information

8. Taxpayer's employer or business

a. How long employed?

b. Business phone no.

c. Occupation

(name and address)

d. Check appropriate item

( ) Wage earner

( ) Sole proprietor

( ) Partner

9. Spouse's employer or business

a. How long employed?

c. Business phone no.

c. Occupation

(name and address)

d. Check appropriate item

( ) Wage earner

( ) Sole proprietor

( ) Partner

Section III.

General Financial Information

10. Bank accounts (include Savings & Loans, Credit Unions, IRA and Retirment Plans, Certificate of Deposits, etc.) Attach additional

sheets as necessary.

Name of Institution

Address

Type of Account

Account No.

Balance

Total (Enter in Item 17)

Form CM-2 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4