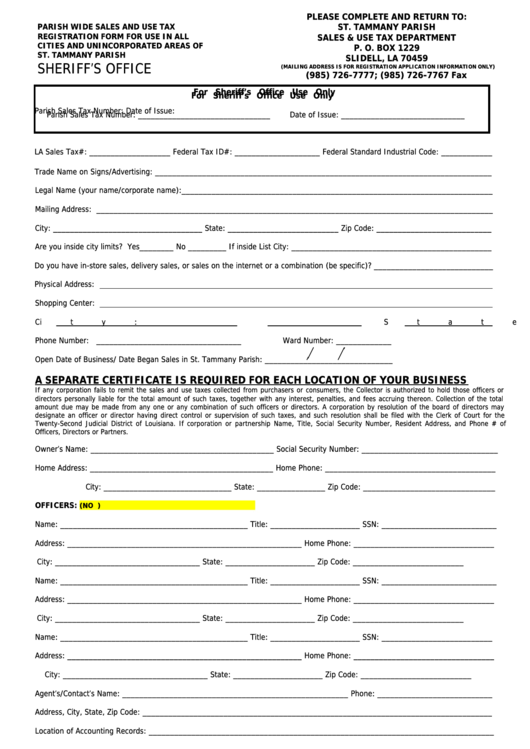

PLEASE COMPLETE AND RETURN TO:

ST. TAMMANY PARISH

PARISH WIDE SALES AND USE TAX

REGISTRATION FORM FOR USE IN ALL

SALES & USE TAX DEPARTMENT

CITIES AND UNINCORPORATED AREAS OF

P. O. BOX 1229

ST. TAMMANY PARISH

SLIDELL, LA 70459

SHERIFF’S OFFICE

(MAILING ADDRESS IS FOR REGISTRATION APPLICATION INFORMATION ONLY)

(985) 726-7777; (985) 726-7767 Fax

For Sheriff’s Office Use Only

For Sheriff’s Office Use Only

Parish Sales Tax Number: Date of Issue:

Parish Sales Tax Number: _______________________________

Date of Issue: _____________________________

LA Sales Tax#: ___________________ Federal Tax ID#: ____________________ Federal Standard Industrial Code: ____________

Trade Name on Signs/Advertising: _______________________________________________________________________________

Legal Name (your name/corporate name):_________________________________________________________________________

Mailing Address: _____________________________________________________________________________________________

City: ___________________________________ State: __________________________ Zip Code: ___________________________

Are you inside city limits? Yes________ No _________ If inside List City: _______________________________________________

Do you have in-store sales, delivery sales, or sales on the internet or a combination (be specific)? ____________________________

Physical Address:

Shopping Center:

City:

State

Zip Code:

Phone Number: __________________________________

Ward Number: _____________

Open Date of Business/ Date Began Sales in St. Tammany Parish: ______________________________

A SEPARATE CERTIFICATE IS REQUIRED FOR EACH LOCATION OF YOUR BUSINESS

If any corporation fails to remit the sales and use taxes collected from purchasers or consumers, the Collector is authorized to hold those officers or

directors personally liable for the total amount of such taxes, together with any interest, penalties, and fees accruing thereon. Collection of the total

amount due may be made from any one or any combination of such officers or directors. A corporation by resolution of the board of directors may

designate an officer or director having direct control or supervision of such taxes, and such resolution shall be filed with the Clerk of Court for the

Twenty-Second Judicial District of Louisiana. If corporation or partnership Name, Title, Social Security Number, Resident Address, and Phone # of

Officers, Directors or Partners.

Owner’s Name: ___________________________________________ Social Security Number: ________________________________

Home Address: ___________________________________________ Home Phone: ________________________________________

City: ______________________________ State: ________________ Zip Code: _______________________________

OFFICERS:

(NO P.O. BOXES MAY BE USED FOR THE ADDRESS)

Name: ____________________________________________ Title: _____________________ SSN: ___________________________

Address: _______________________________________________________ Home Phone: _________________________________

City: __________________________________ State: _____________________ Zip Code: __________________________

Name: ____________________________________________ Title: _____________________ SSN: ___________________________

Address: _______________________________________________________ Home Phone: _________________________________

City: __________________________________ State: _____________________ Zip Code: __________________________

Name: ____________________________________________ Title: _____________________ SSN: __________________________

Address: _______________________________________________________ Home Phone: _________________________________

City: __________________________________ State: _____________________ Zip Code: __________________________

Agent’s/Contact’s Name: _____________________________________________________ Phone: ___________________________

Address, City, State, Zip Code: __________________________________________________________________________________

Location of Accounting Records: _________________________________________________________________________________

Description of Activity that will generate the collection of Sales and Use Tax: _____________________________________________

If an individual is an applicant for a certificate required by this Ordinance, the application must be signed by him; if a partnership or an association of

persons, by a member of the firm; and if a corporation, by the proper officer thereof. Any intentional false statement as to any material facts in the

application for a certificate shall constitute a misdemeanor.

SIGNATURE OF APPLICANT: __________________________________________ DATE: ______________________

PRINT OR TYPE APPLICANT’S NAME AND TITLE: ______________________________________________________

1

1