Instructions For Form Ri-1096pt - Rhode Island Withholding Of A Pass-Through Entity With Nonresident Partners, Members, Beneficiaries And Shareholders - 2012

ADVERTISEMENT

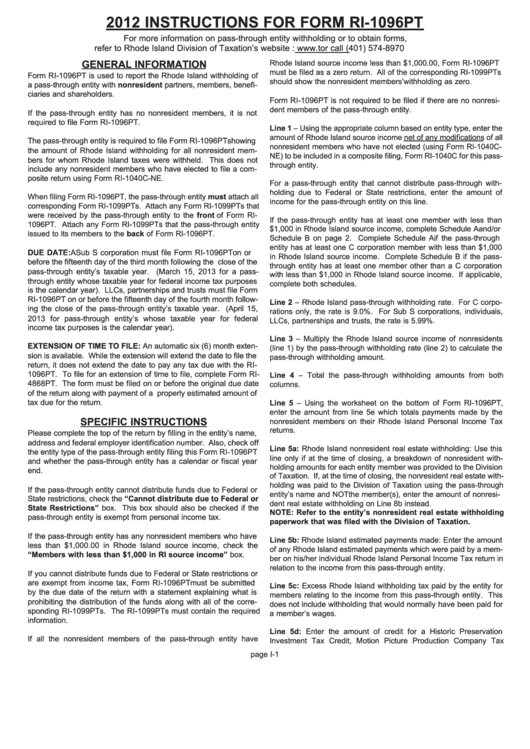

2012 INSTRUCTIONS FOR FORM RI-1096PT

For more information on pass-through entity withholding or to obtain forms,

refer to Rhode Island Division of Taxation’s website : or call (401) 574-8970

GENERAL INFORMATION

Rhode Island source income less than $1,000.00, Form RI-1096PT

must be filed as a zero return. All of the corresponding RI-1099PTs

Form RI-1096PT is used to report the Rhode Island withholding of

should show the nonresident members’ withholding as zero.

a pass-through entity with nonresident partners, members, benefi-

ciaries and shareholders.

Form RI-1096PT is not required to be filed if there are no nonresi-

dent members of the pass-through entity.

If the pass-through entity has no nonresident members, it is not

required to file Form RI-1096PT.

Line 1 – Using the appropriate column based on entity type, enter the

amount of Rhode Island source income net of any modifications of all

The pass-through entity is required to file Form RI-1096PT showing

nonresident members who have not elected (using Form RI-1040C-

the amount of Rhode Island withholding for all nonresident mem-

NE) to be included in a composite filing, Form RI-1040C for this pass-

bers for whom Rhode Island taxes were withheld. This does not

through entity.

include any nonresident members who have elected to file a com-

posite return using Form RI-1040C-NE.

For a pass-through entity that cannot distribute pass-through with-

holding due to Federal or State restrictions, enter the amount of

When filing Form RI-1096PT, the pass-through entity must attach all

income for the pass-through entity on this line.

corresponding Form RI-1099PTs. Attach any Form RI-1099PTs that

were received by the pass-through entity to the front of Form RI-

If the pass-through entity has at least one member with less than

1096PT. Attach any Form RI-1099PTs that the pass-through entity

$1,000 in Rhode Island source income, complete Schedule A and/or

issued to its members to the back of Form RI-1096PT.

Schedule B on page 2. Complete Schedule A if the pass-through

entity has at least one C corporation member with less than $1,000

DUE DATE: A Sub S corporation must file Form RI-1096PT on or

in Rhode Island source income. Complete Schedule B if the pass-

before the fifteenth day of the third month following the close of the

through entity has at least one member other than a C corporation

pass-through entity’s taxable year. (March 15, 2013 for a pass-

with less than $1,000 in Rhode Island source income. If applicable,

through entity whose taxable year for federal income tax purposes

complete both schedules.

is the calendar year). LLCs, partnerships and trusts must file Form

RI-1096PT on or before the fifteenth day of the fourth month follow-

Line 2 – Rhode Island pass-through withholding rate. For C corpo-

ing the close of the pass-through entity’s taxable year. (April 15,

rations only, the rate is 9.0%. For Sub S corporations, individuals,

2013 for pass-through entity’s whose taxable year for federal

LLCs, partnerships and trusts, the rate is 5.99%.

income tax purposes is the calendar year).

Line 3 – Multiply the Rhode Island source income of nonresidents

EXTENSION OF TIME TO FILE: An automatic six (6) month exten-

(line 1) by the pass-through withholding rate (line 2) to calculate the

sion is available. While the extension will extend the date to file the

pass-through withholding amount.

return, it does not extend the date to pay any tax due with the RI-

1096PT. To file for an extension of time to file, complete Form RI-

Line 4 – Total the pass-through withholding amounts from both

4868PT. The form must be filed on or before the original due date

columns.

of the return along with payment of a properly estimated amount of

tax due for the return.

Line 5 – Using the worksheet on the bottom of Form RI-1096PT,

enter the amount from line 5e which totals payments made by the

SPECIFIC INSTRUCTIONS

nonresident members on their Rhode Island Personal Income Tax

returns.

Please complete the top of the return by filling in the entity’s name,

address and federal employer identification number. Also, check off

Line 5a: Rhode Island nonresident real estate withholding: Use this

the entity type of the pass-through entity filing this Form RI-1096PT

line only if at the time of closing, a breakdown of nonresident with-

and whether the pass-through entity has a calendar or fiscal year

holding amounts for each entity member was provided to the Division

end.

of Taxation. If, at the time of closing, the nonresident real estate with-

holding was paid to the Division of Taxation using the pass-through

If the pass-through entity cannot distribute funds due to Federal or

entity’s name and NOT the member(s), enter the amount of nonresi-

State restrictions, check the “Cannot distribute due to Federal or

dent real estate withholding on Line 8b instead.

State Restrictions” box. This box should also be checked if the

NOTE: Refer to the entity’s nonresident real estate withholding

pass-through entity is exempt from personal income tax.

paperwork that was filed with the Division of Taxation.

If the pass-through entity has any nonresident members who have

Line 5b: Rhode Island estimated payments made: Enter the amount

less than $1,000.00 in Rhode Island source income, check the

of any Rhode Island estimated payments which were paid by a mem-

“Members with less than $1,000 in RI source income” box.

ber on his/her individual Rhode Island Personal Income Tax return in

relation to the income from this pass-through entity.

If you cannot distribute funds due to Federal or State restrictions or

are exempt from income tax, Form RI-1096PT must be submitted

Line 5c: Excess Rhode Island withholding tax paid by the entity for

by the due date of the return with a statement explaining what is

members relating to the income from this pass-through entity. This

prohibiting the distribution of the funds along with all of the corre-

does not include withholding that would normally have been paid for

sponding RI-1099PTs. The RI-1099PTs must contain the required

a member’s wages.

information.

Line 5d: Enter the amount of credit for a Historic Preservation

If all the nonresident members of the pass-through entity have

Investment Tax Credit, Motion Picture Production Company Tax

page I-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2