Instructions For Form Ftb 3532 - Head Of Household Filing Status Schedule - 2016

ADVERTISEMENT

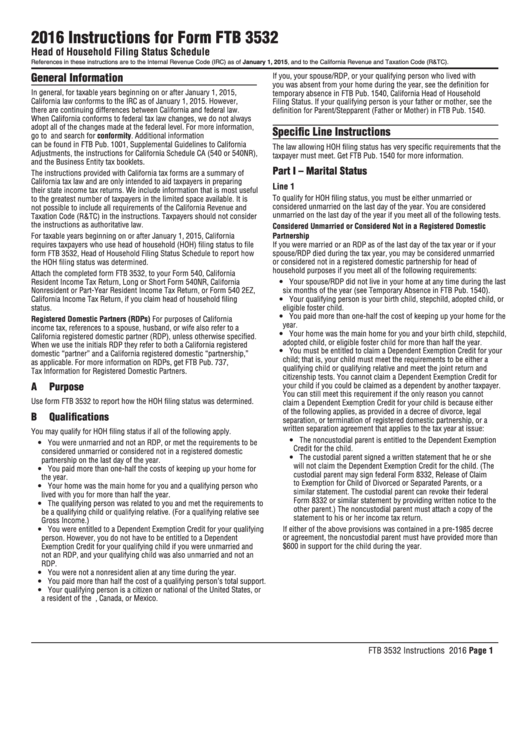

2016 Instructions for Form FTB 3532

Head of Household Filing Status Schedule

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

General Information

If you, your spouse/RDP, or your qualifying person who lived with

you was absent from your home during the year, see the definition for

In general, for taxable years beginning on or after January 1, 2015,

temporary absence in FTB Pub. 1540, California Head of Household

California law conforms to the IRC as of January 1, 2015. However,

Filing Status. If your qualifying person is your father or mother, see the

there are continuing differences between California and federal law.

definition for Parent/Stepparent (Father or Mother) in FTB Pub. 1540.

When California conforms to federal tax law changes, we do not always

adopt all of the changes made at the federal level. For more information,

Specific Line Instructions

go to ftb.ca.gov and search for conformity. Additional information

can be found in FTB Pub. 1001, Supplemental Guidelines to California

The law allowing HOH filing status has very specific requirements that the

Adjustments, the instructions for California Schedule CA (540 or 540NR),

taxpayer must meet. Get FTB Pub. 1540 for more information.

and the Business Entity tax booklets.

Part I – Marital Status

The instructions provided with California tax forms are a summary of

California tax law and are only intended to aid taxpayers in preparing

Line 1

their state income tax returns. We include information that is most useful

To qualify for HOH filing status, you must be either unmarried or

to the greatest number of taxpayers in the limited space available. It is

considered unmarried on the last day of the year. You are considered

not possible to include all requirements of the California Revenue and

unmarried on the last day of the year if you meet all of the following tests.

Taxation Code (R&TC) in the instructions. Taxpayers should not consider

the instructions as authoritative law.

Considered Unmarried or Considered Not in a Registered Domestic

Partnership

For taxable years beginning on or after January 1, 2015, California

requires taxpayers who use head of household (HOH) filing status to file

If you were married or an RDP as of the last day of the tax year or if your

form FTB 3532, Head of Household Filing Status Schedule to report how

spouse/RDP died during the tax year, you may be considered unmarried

or considered not in a registered domestic partnership for head of

the HOH filing status was determined.

household purposes if you meet all of the following requirements:

Attach the completed form FTB 3532, to your Form 540, California

Resident Income Tax Return, Long or Short Form 540NR, California

y Your spouse/RDP did not live in your home at any time during the last

six months of the year (see Temporary Absence in FTB Pub. 1540).

Nonresident or Part-Year Resident Income Tax Return, or Form 540 2EZ,

y Your qualifying person is your birth child, stepchild, adopted child, or

California Income Tax Return, if you claim head of household filing

status.

eligible foster child.

y You paid more than one-half the cost of keeping up your home for the

Registered Domestic Partners (RDPs) For purposes of California

year.

income tax, references to a spouse, husband, or wife also refer to a

y Your home was the main home for you and your birth child, stepchild,

California registered domestic partner (RDP), unless otherwise specified.

adopted child, or eligible foster child for more than half the year.

When we use the initials RDP they refer to both a California registered

y You must be entitled to claim a Dependent Exemption Credit for your

domestic “partner” and a California registered domestic “partnership,”

child; that is, your child must meet the requirements to be either a

as applicable. For more information on RDPs, get FTB Pub. 737,

qualifying child or qualifying relative and meet the joint return and

Tax Information for Registered Domestic Partners.

citizenship tests. You cannot claim a Dependent Exemption Credit for

A

Purpose

your child if you could be claimed as a dependent by another taxpayer.

You can still meet this requirement if the only reason you cannot

Use form FTB 3532 to report how the HOH filing status was determined.

claim a Dependent Exemption Credit for your child is because either

of the following applies, as provided in a decree of divorce, legal

B

Qualifications

separation, or termination of registered domestic partnership, or a

written separation agreement that applies to the tax year at issue:

You may qualify for HOH filing status if all of the following apply.

y The noncustodial parent is entitled to the Dependent Exemption

y You were unmarried and not an RDP, or met the requirements to be

Credit for the child.

considered unmarried or considered not in a registered domestic

y The custodial parent signed a written statement that he or she

partnership on the last day of the year.

will not claim the Dependent Exemption Credit for the child. (The

y You paid more than one-half the costs of keeping up your home for

custodial parent may sign federal Form 8332, Release of Claim

the year.

to Exemption for Child of Divorced or Separated Parents, or a

y Your home was the main home for you and a qualifying person who

similar statement. The custodial parent can revoke their federal

lived with you for more than half the year.

Form 8332 or similar statement by providing written notice to the

y The qualifying person was related to you and met the requirements to

other parent.) The noncustodial parent must attach a copy of the

be a qualifying child or qualifying relative. (For a qualifying relative see

statement to his or her income tax return.

Gross Income.)

If either of the above provisions was contained in a pre-1985 decree

y You were entitled to a Dependent Exemption Credit for your qualifying

or agreement, the noncustodial parent must have provided more than

person. However, you do not have to be entitled to a Dependent

Exemption Credit for your qualifying child if you were unmarried and

$600 in support for the child during the year.

not an RDP, and your qualifying child was also unmarried and not an

RDP.

y You were not a nonresident alien at any time during the year.

y You paid more than half the cost of a qualifying person’s total support.

y Your qualifying person is a citizen or national of the United States, or

a resident of the U.S., Canada, or Mexico.

FTB 3532 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2