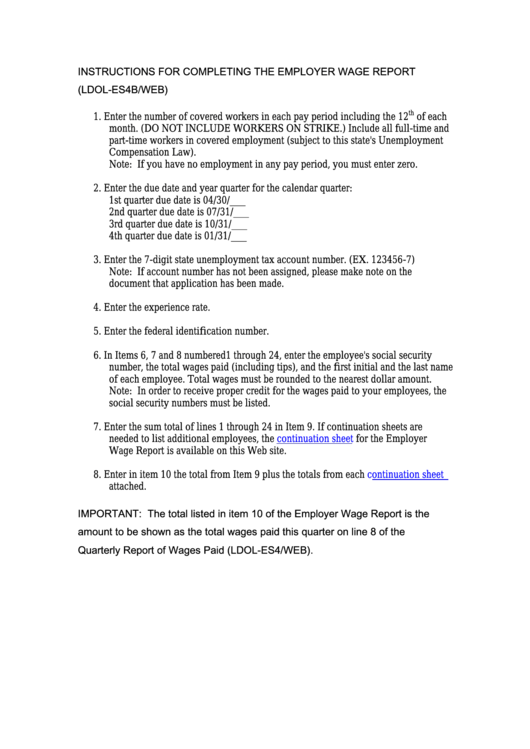

Instructions For Form Ldol-Es4b/web - Employer Wage Report

ADVERTISEMENT

th

1. Enter the number of covered workers in each pay period including the 12

of each

month. (DO NOT INCLUDE WORKERS ON STRIKE.) Include all full-time and

part-time workers in covered employment (subject to this state's Unemployment

Compensation Law).

Note: If you have no employment in any pay period, you must enter zero.

2. Enter the due date and year quarter for the calendar quarter:

1st quarter due date is 04/30/___

2nd quarter due date is 07/31/___

3rd quarter due date is 10/31/___

4th quarter due date is 01/31/___

3. Enter the 7-digit state unemployment tax account number. (EX. 123456-7)

Note: If account number has not been assigned, please make note on the

document that application has been made.

4. Enter the experience rate.

5. Enter the federal identification number.

6. In Items 6, 7 and 8 numbered1 through 24, enter the employee's social security

number, the total wages paid (including tips), and the first initial and the last name

of each employee. Total wages must be rounded to the nearest dollar amount.

Note: In order to receive proper credit for the wages paid to your employees, the

social security numbers must be listed.

7. Enter the sum total of lines 1 through 24 in Item 9. If continuation sheets are

needed to list additional employees, the

continuation sheet

for the Employer

Wage Report is available on this Web site.

8. Enter in item 10 the total from Item 9 plus the totals from each

continuation sheet

attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1