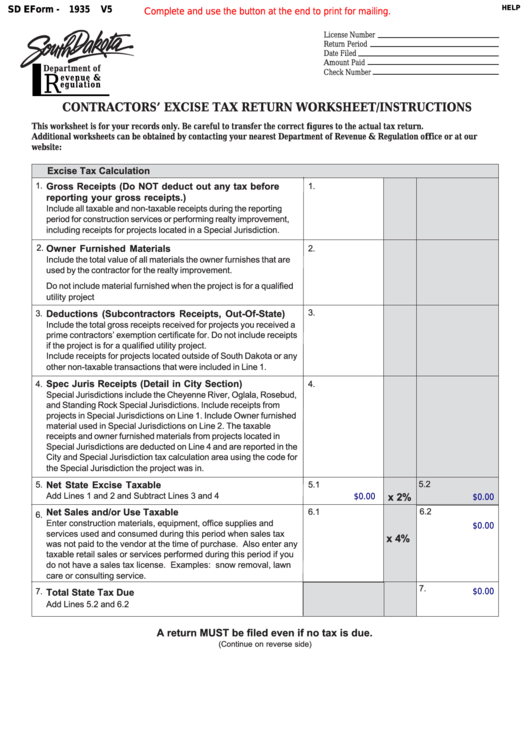

Form 1935 - South Dakota Contractors' Excise Tax Return Worksheet/instructions

ADVERTISEMENT

HELP

SD EForm - 1935

V5

Complete and use the button at the end to print for mailing.

License Number

Return Period

Date Filed

Amount Paid

Department of

Check Number

evenue &

R

egulation

CONTRACTORS’ EXCISE TAX RETURN WORKSHEET/INSTRUCTIONS

This worksheet is for your records only. Be careful to transfer the correct figures to the actual tax return.

Additional worksheets can be obtained by contacting your nearest Department of Revenue & Regulation office or at our

website:

Excise Tax Calculation

Gross Receipts (Do NOT deduct out any tax before

1.

1.

reporting your gross receipts.)

Include all taxable and non-taxable receipts during the reporting

period for construction services or performing realty improvement,

including receipts for projects located in a Special Jurisdiction.

2.

Owner Furnished Materials

2.

Include the total value of all materials the owner furnishes that are

used by the contractor for the realty improvement.

Do not include material furnished when the project is for a qualified

utility project

3.

3.

Deductions (Subcontractors Receipts, Out-Of-State)

Include the total gross receipts received for projects you received a

prime contractors’ exemption certificate for. Do not include receipts

if the project is for a qualified utility project.

Include receipts for projects located outside of South Dakota or any

other non-taxable transactions that were included in Line 1.

Spec Juris Receipts (Detail in City Section)

4.

4.

Special Jurisdictions include the Cheyenne River, Oglala, Rosebud,

and Standing Rock Special Jurisdictions. Include receipts from

projects in Special Jurisdictions on Line 1. Include Owner furnished

material used in Special Jurisdictions on Line 2. The taxable

receipts and owner furnished materials from projects located in

Special Jurisdictions are deducted on Line 4 and are reported in the

City and Special Jurisdiction tax calculation area using the code for

the Special Jurisdiction the project was in.

5.2

5.

Net State Excise Taxable

5.1

Add Lines 1 and 2 and Subtract Lines 3 and 4

x 2%

$0.00

$0.00

Net Sales and/or Use Taxable

6.1

6.2

6.

Enter construction materials, equipment, office supplies and

$0.00

services used and consumed during this period when sales tax

x 4%

was not paid to the vendor at the time of purchase. Also enter any

taxable retail sales or services performed during this period if you

do not have a sales tax license. Examples: snow removal, lawn

care or consulting service.

7.

7.

Total State Tax Due

$0.00

Add Lines 5.2 and 6.2

A return MUST be filed even if no tax is due.

(Continue on reverse side)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2