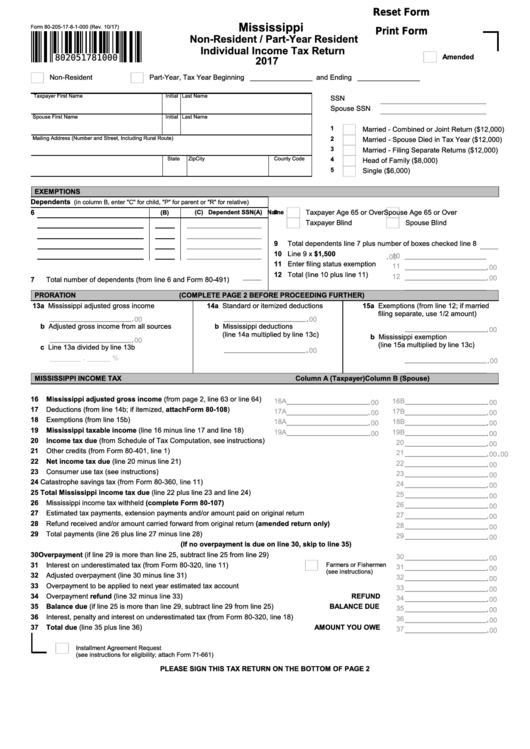

Reset Form

Mississippi

Form 80-205-17-8-1-000 (Rev. 10/17)

Print Form

Non-Resident / Part-Year Resident

Individual Income Tax Return

Amended

802051781000

2017

Non-Resident

Part-Year, Tax Year Beginning ________________ and Ending ________________

Taxpayer First Name

Initial

Last Name

SSN

Spouse SSN

Spouse First Name

Initial

Last Name

1

Married - Combined or Joint Return ($12,000)

Mailing Address (Number and Street, Including Rural Route)

2

Married - Spouse Died in Tax Year ($12,000)

3

Married - Filing Separate Returns ($12,000)

City

State

Zip

County Code

4

Head of Family ($8,000)

5

Single ($6,000)

EXEMPTIONS

Dependents

(in column B, enter "C" for child, "P" for parent or "R" for relative)

6

Taxpayer Age 65 or Over

Spouse Age 65 or Over

(A) Name

(B)

(C) Dependent SSN

8

Taxpayer Blind

Spouse Blind

9

Total dependents line 7 plus number of boxes checked line 8

.

10 Line 9 x $1,500

10

00

.

11 Enter filing status exemption

11

00

.

12 Total (line 10 plus line 11)

12

00

7

Total number of dependents (from line 6 and Form 80-491)

PRORATION

(COMPLETE PAGE 2 BEFORE PROCEEDING FURTHER)

13a Mississippi adjusted gross income

14a Standard or itemized deductions

15a Exemptions (from line 12; if married

filing separate, use 1/2 amount)

.

.

00

00

.

b Adjusted gross income from all sources

b Mississippi deductions

00

(line 14a multiplied by line 13c)

.

b Mississippi exemption

00

(line 15a multiplied by line 13c)

.

c Line 13a divided by line 13b

00

.

.

________

______ %

00

MISSISSIPPI INCOME TAX

Column A (Taxpayer)

Column B (Spouse)

.

.

16

Mississippi adjusted gross income (from page 2, line 63 or line 64)

16A

16B

00

00

.

.

17

Deductions (from line 14b; if itemized, attach Form 80-108)

17A

17B

00

00

.

.

18

Exemptions (from line 15b)

18A

18B

00

00

.

.

19

Mississippi taxable income (line 16 minus line 17 and line 18)

19A

19B

00

00

.

20

Income tax due (from Schedule of Tax Computation, see instructions)

20

00

.

.

21

Other credits (from Form 80-401, line 1)

21

00

00

.

22

Net income tax due (line 20 minus line 21)

22

00

.

23

Consumer use tax (see instructions)

23

00

.

24

Catastrophe savings tax (from Form 80-360, line 11)

24

00

.

25

Total Mississippi income tax due (line 22 plus line 23 and line 24)

25

00

.

26

Mississippi income tax withheld (complete Form 80-107)

26

00

.

27

Estimated tax payments, extension payments and/or amount paid on original return

27

00

.

28

Refund received and/or amount carried forward from original return (amended return only)

28

00

.

29

Total payments (line 26 plus line 27 minus line 28)

29

00

(If no overpayment is due on line 30, skip to line 35)

.

30

Overpayment (if line 29 is more than line 25, subtract line 25 from line 29)

30

00

.

31

Interest on underestimated tax (from Form 80-320, line 11)

Farmers or Fishermen

31

00

(see instructions)

.

32

Adjusted overpayment (line 30 minus line 31)

32

00

.

33

Overpayment to be applied to next year estimated tax account

33

00

.

34

Overpayment refund (line 32 minus line 33)

REFUND

34

00

.

35

Balance due (if line 25 is more than line 29, subtract line 29 from line 25)

BALANCE DUE

35

00

.

36

Interest, penalty and interest on underestimated tax (from Form 80-320, line 18)

36

00

.

37

Total due (line 35 plus line 36)

AMOUNT YOU OWE

37

00

Installment Agreement Request

(see instructions for eligibility; attach Form 71-661)

PLEASE SIGN THIS TAX RETURN ON THE BOTTOM OF PAGE 2

1

1 2

2