Instructions For Form Ftb 3805v - Net Operating Loss (Nol) Computation And Nol And Disaster Loss Limitations - Individuals, Estates, And Trusts - 2016

ADVERTISEMENT

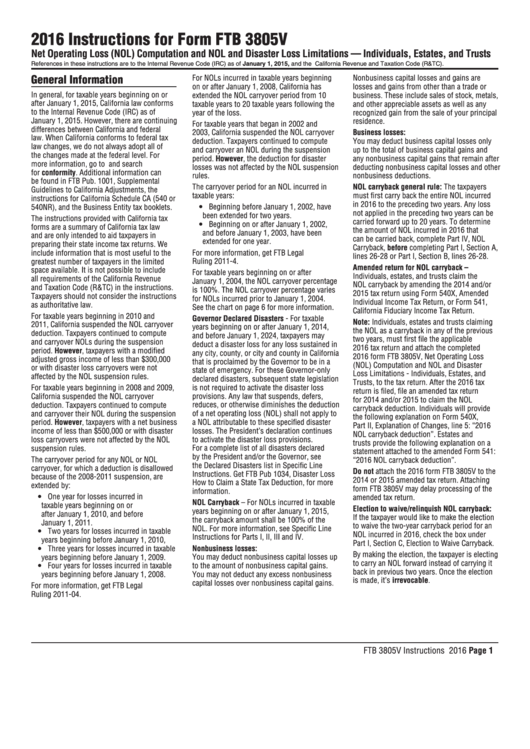

2016 Instructions for Form FTB 3805V

Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations — Individuals, Estates, and Trusts

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

General Information

For NOLs incurred in taxable years beginning

Nonbusiness capital losses and gains are

on or after January 1, 2008, California has

losses and gains from other than a trade or

In general, for taxable years beginning on or

extended the NOL carryover period from 10

business. These include sales of stock, metals,

after January 1, 2015, California law conforms

taxable years to 20 taxable years following the

and other appreciable assets as well as any

to the Internal Revenue Code (IRC) as of

year of the loss.

recognized gain from the sale of your principal

January 1, 2015. However, there are continuing

residence.

For taxable years that began in 2002 and

differences between California and federal

2003, California suspended the NOL carryover

Business losses:

law. When California conforms to federal tax

deduction. Taxpayers continued to compute

You may deduct business capital losses only

law changes, we do not always adopt all of

and carryover an NOL during the suspension

up to the total of business capital gains and

the changes made at the federal level. For

period. However, the deduction for disaster

any nonbusiness capital gains that remain after

more information, go to ftb.ca.gov and search

losses was not affected by the NOL suspension

deducting nonbusiness capital losses and other

for conformity. Additional information can

rules.

nonbusiness deductions.

be found in FTB Pub. 1001, Supplemental

The carryover period for an NOL incurred in

NOL carryback general rule: The taxpayers

Guidelines to California Adjustments, the

taxable years:

must first carry back the entire NOL incurred

instructions for California Schedule CA (540 or

in 2016 to the preceding two years. Any loss

540NR), and the Business Entity tax booklets.

y Beginning before January 1, 2002, have

not applied in the preceding two years can be

been extended for two years.

The instructions provided with California tax

carried forward up to 20 years. To determine

y Beginning on or after January 1, 2002,

forms are a summary of California tax law

the amount of NOL incurred in 2016 that

and before January 1, 2003, have been

and are only intended to aid taxpayers in

can be carried back, complete Part IV, NOL

extended for one year.

preparing their state income tax returns. We

Carryback, before completing Part I, Section A,

include information that is most useful to the

For more information, get FTB Legal

lines 26-28 or Part I, Section B, lines 26-28.

Ruling 2011-4.

greatest number of taxpayers in the limited

Amended return for NOL carryback –

space available. It is not possible to include

For taxable years beginning on or after

Individuals, estates, and trusts claim the

all requirements of the California Revenue

January 1, 2004, the NOL carryover percentage

NOL carryback by amending the 2014 and/or

and Taxation Code (R&TC) in the instructions.

is 100%. The NOL carryover percentage varies

2015 tax return using Form 540X, Amended

Taxpayers should not consider the instructions

for NOLs incurred prior to January 1, 2004.

Individual Income Tax Return, or Form 541,

as authoritative law.

See the chart on page 6 for more information.

California Fiduciary Income Tax Return.

For taxable years beginning in 2010 and

Governor Declared Disasters - For taxable

Note: Individuals, estates and trusts claiming

2011, California suspended the NOL carryover

years beginning on or after January 1, 2014,

the NOL as a carryback in any of the previous

deduction. Taxpayers continued to compute

and before January 1, 2024, taxpayers may

two years, must first file the applicable

and carryover NOLs during the suspension

deduct a disaster loss for any loss sustained in

2016 tax return and attach the completed

period. However, taxpayers with a modified

any city, county, or city and county in California

2016 form FTB 3805V, Net Operating Loss

adjusted gross income of less than $300,000

that is proclaimed by the Governor to be in a

(NOL) Computation and NOL and Disaster

or with disaster loss carryovers were not

state of emergency. For these Governor-only

Loss Limitations - Individuals, Estates, and

affected by the NOL suspension rules.

declared disasters, subsequent state legislation

Trusts, to the tax return. After the 2016 tax

For taxable years beginning in 2008 and 2009,

is not required to activate the disaster loss

return is filed, file an amended tax return

provisions. Any law that suspends, defers,

California suspended the NOL carryover

for 2014 and/or 2015 to claim the NOL

deduction. Taxpayers continued to compute

reduces, or otherwise diminishes the deduction

carryback deduction. Individuals will provide

and carryover their NOL during the suspension

of a net operating loss (NOL) shall not apply to

the following explanation on Form 540X,

period. However, taxpayers with a net business

a NOL attributable to these specified disaster

Part II, Explanation of Changes, line 5: “2016

losses. The President’s declaration continues

income of less than $500,000 or with disaster

NOL carryback deduction”. Estates and

to activate the disaster loss provisions.

loss carryovers were not affected by the NOL

trusts provide the following explanation on a

suspension rules.

For a complete list of all disasters declared

statement attached to the amended Form 541:

by the President and/or the Governor, see

The carryover period for any NOL or NOL

“2016 NOL carryback deduction”.

the Declared Disasters list in Specific Line

carryover, for which a deduction is disallowed

Do not attach the 2016 form FTB 3805V to the

Instructions. Get FTB Pub 1034, Disaster Loss

because of the 2008-2011 suspension, are

2014 or 2015 amended tax return. Attaching

How to Claim a State Tax Deduction, for more

extended by:

form FTB 3805V may delay processing of the

information.

y One year for losses incurred in

amended tax return.

NOL Carryback – For NOLs incurred in taxable

taxable years beginning on or

Election to waive/relinquish NOL carryback:

years beginning on or after January 1, 2015,

after January 1, 2010, and before

If the taxpayer would like to make the election

the carryback amount shall be 100% of the

January 1, 2011.

to waive the two-year carryback period for an

NOL. For more information, see Specific Line

y Two years for losses incurred in taxable

NOL incurred in 2016, check the box under

Instructions for Parts I, II, III and IV.

years beginning before January 1, 2010,

Part I, Section C, Election to Waive Carryback.

y Three years for losses incurred in taxable

Nonbusiness losses:

By making the election, the taxpayer is electing

years beginning before January 1, 2009.

You may deduct nonbusiness capital losses up

to carry an NOL forward instead of carrying it

to the amount of nonbusiness capital gains.

y Four years for losses incurred in taxable

back in previous two years. Once the election

years beginning before January 1, 2008.

You may not deduct any excess nonbusiness

is made, it’s irrevocable.

capital losses over nonbusiness capital gains.

For more information, get FTB Legal

Ruling 2011-04.

FTB 3805V Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6