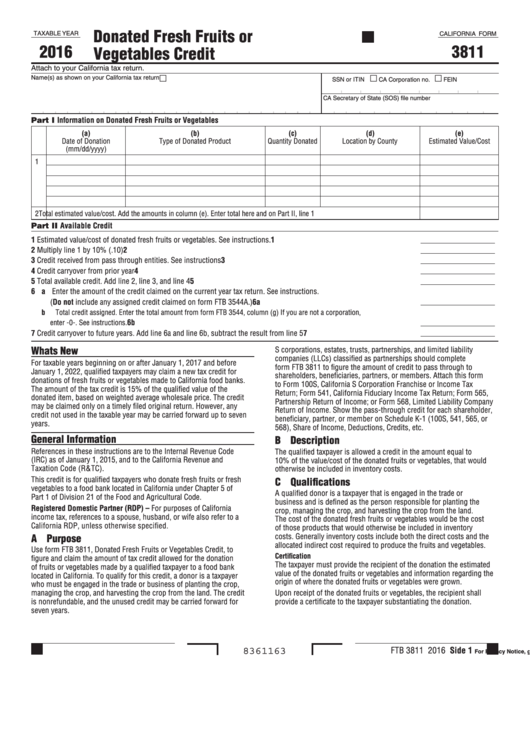

Donated Fresh Fruits or

TAXABLE YEAR

CALIFORNIA FORM

2016

3811

Vegetables Credit

Attach to your California tax return.

m

m

m

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

CA Secretary of State (SOS) file number

Part I Information on Donated Fresh Fruits or Vegetables

(a)

(b)

(c)

(d)

(e)

Date of Donation

Type of Donated Product

Quantity Donated

Location by County

Estimated Value/Cost

(mm/dd/yyyy)

1

2

Total estimated value/cost. Add the amounts in column (e). Enter total here and on Part II, line 1. . . . . . . . . . . . . . . . . . . . . . .

Part II Available Credit

1 Estimated value/cost of donated fresh fruits or vegetables. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Multiply line 1 by 10% (.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3 Credit received from pass through entities. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

4 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

5 Total available credit. Add line 2, line 3, and line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

6 a Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544A.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6a

b Total credit assigned. Enter the total amount from form FTB 3544, column (g) If you are not a corporation,

enter -0-. See instructions.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6b

7 Credit carryover to future years. Add line 6a and line 6b, subtract the result from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Whats New

S corporations, estates, trusts, partnerships, and limited liability

companies (LLCs) classified as partnerships should complete

For taxable years beginning on or after January 1, 2017 and before

form FTB 3811 to figure the amount of credit to pass through to

January 1, 2022, qualified taxpayers may claim a new tax credit for

shareholders, beneficiaries, partners, or members. Attach this form

donations of fresh fruits or vegetables made to California food banks.

to Form 100S, California S Corporation Franchise or Income Tax

The amount of the tax credit is 15% of the qualified value of the

Return; Form 541, California Fiduciary Income Tax Return; Form 565,

donated item, based on weighted average wholesale price. The credit

Partnership Return of Income; or Form 568, Limited Liability Company

may be claimed only on a timely filed original return. However, any

Return of Income. Show the pass-through credit for each shareholder,

credit not used in the taxable year may be carried forward up to seven

beneficiary, partner, or member on Schedule K-1 (100S, 541, 565, or

years.

568), Share of Income, Deductions, Credits, etc.

General Information

B Description

References in these instructions are to the Internal Revenue Code

The qualified taxpayer is allowed a credit in the amount equal to

(IRC) as of January 1, 2015, and to the California Revenue and

10% of the value/cost of the donated fruits or vegetables, that would

Taxation Code (R&TC).

otherwise be included in inventory costs.

This credit is for qualified taxpayers who donate fresh fruits or fresh

C Qualifications

vegetables to a food bank located in California under Chapter 5 of

A qualified donor is a taxpayer that is engaged in the trade or

Part 1 of Division 21 of the Food and Agricultural Code.

business and is defined as the person responsible for planting the

Registered Domestic Partner (RDP) – For purposes of California

crop, managing the crop, and harvesting the crop from the land.

income tax, references to a spouse, husband, or wife also refer to a

The cost of the donated fresh fruits or vegetables would be the cost

California RDP, unless otherwise specified.

of those products that would otherwise be included in inventory

costs. Generally inventory costs include both the direct costs and the

A Purpose

allocated indirect cost required to produce the fruits and vegetables.

Use form FTB 3811, Donated Fresh Fruits or Vegetables Credit, to

Certification

figure and claim the amount of tax credit allowed for the donation

The taxpayer must provide the recipient of the donation the estimated

of fruits or vegetables made by a qualified taxpayer to a food bank

value of the donated fruits or vegetables and information regarding the

located in California. To qualify for this credit, a donor is a taxpayer

origin of where the donated fruits or vegetables were grown.

who must be engaged in the trade or business of planting the crop,

managing the crop, and harvesting the crop from the land. The credit

Upon receipt of the donated fruits or vegetables, the recipient shall

is nonrefundable, and the unused credit may be carried forward for

provide a certificate to the taxpayer substantiating the donation.

seven years.

FTB 3811 2016 Side 1

8361163

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2