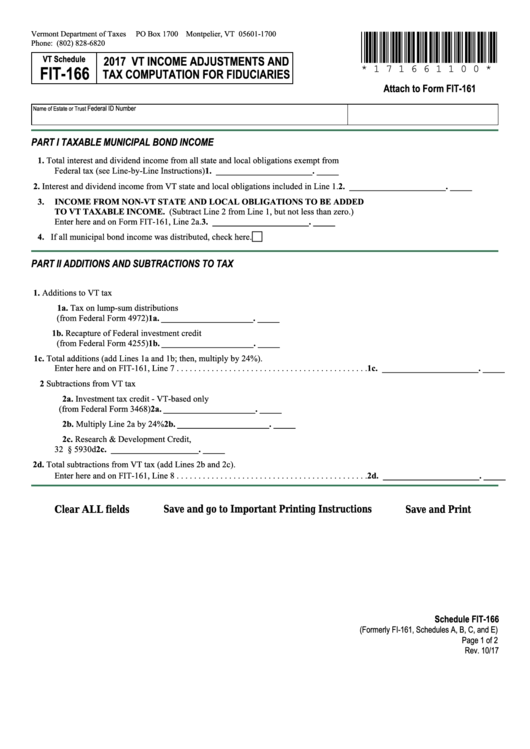

Vermont Department of Taxes

PO Box 1700 Montpelier, VT 05601-1700

*171661100*

Phone: (802) 828-6820

2017 VT INCOME ADJUSTMENTS AND

VT Schedule

FIT-166

* 1 7 1 6 6 1 1 0 0 *

TAX COMPUTATION FOR FIDUCIARIES

Attach to Form FIT-161

Federal ID Number

Name of Estate or Trust

PART I

TAXABLE MUNICIPAL BOND INCOME

1.

Total interest and dividend income from all state and local obligations exempt from

Federal tax (see Line-by-Line Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ______________________. _____

2.

Interest and dividend income from VT state and local obligations included in Line 1 . . . . . 2. ______________________. _____

3.

INCOME FROM NON-VT STATE AND LOCAL OBLIGATIONS TO BE ADDED

TO VT TAXABLE INCOME. (Subtract Line 2 from Line 1, but not less than zero .)

Enter here and on Form FIT-161, Line 2a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ______________________. _____

4.

If all municipal bond income was distributed, check here .

c

PART II

ADDITIONS AND SUBTRACTIONS TO TAX

1.

Additions to VT tax

1a. Tax on lump-sum distributions

(from Federal Form 4972) . . . . . . . . . . . . . . . . . . 1a. _____________________ . _____

1b. Recapture of Federal investment credit

(from Federal Form 4255) . . . . . . . . . . . . . . . . . . 1b. _____________________. _____

1c.

Total additions (add Lines 1a and 1b; then, multiply by 24%) .

Enter here and on FIT-161, Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c. ______________________. _____

2

Subtractions from VT tax

2a.

Investment tax credit - VT-based only

(from Federal Form 3468) . . . . . . . . . . . 2a. _____________________. _____

2b.

Multiply Line 2a by 24% . . . . . . . . . . . . 2b. _____________________. _____

2c.

Research & Development Credit,

32 V .S .A . § 5930d . . . . . . . . . . . . . . . . . . 2c. ____________________. _____

2d.

Total subtractions from VT tax (add Lines 2b and 2c) .

Enter here and on FIT-161, Line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2d. ______________________. _____

Clear ALL fields

Save and Print

Save and go to Important Printing Instructions

Schedule FIT-166

(Formerly FI-161, Schedules A, B, C, and E)

Page 1 of 2

Rev. 10/17

1

1 2

2