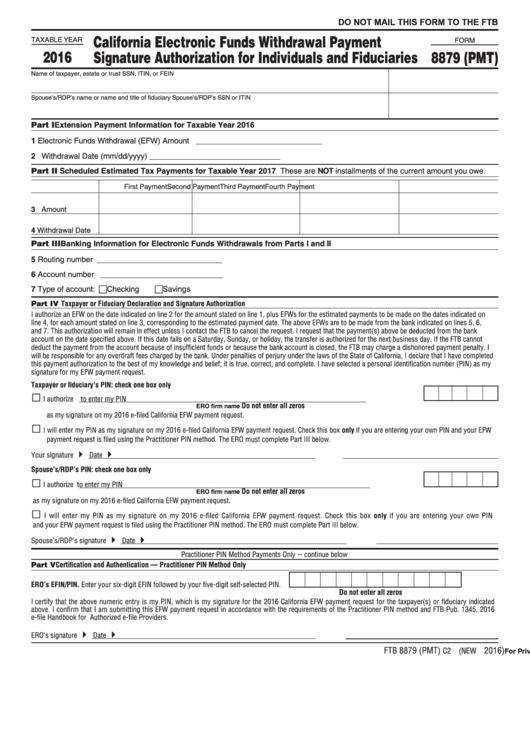

Form 8879 (Pmt) - California Electronic Funds Withdrawal Payment Signature Authorization For Individuals And Fiduciaries - 2016

ADVERTISEMENT

DO NOT MAIL THIS FORM TO THE FTB

California Electronic Funds Withdrawal Payment

TAXABLE YEAR

FORM

2016

Signature Authorization for Individuals and Fiduciaries

8879 (PMT)

Name of taxpayer, estate or trust

SSN, ITIN, or FEIN

Spouse’s/RDP’s name or name and title of fiduciary

Spouse’s/RDP’s SSN or ITIN

Part I

Extension Payment Information for Taxable Year 2016

1 Electronic Funds Withdrawal (EFW) Amount

2 Withdrawal Date (mm/dd/yyyy)

Part II

Scheduled Estimated Tax Payments for Taxable Year 2017 These are NOT installments of the current amount you owe.

First Payment

Second Payment

Third Payment

Fourth Payment

3 Amount

4 Withdrawal Date

Part III Banking Information for Electronic Funds Withdrawals from Parts I and II

5 Routing number

6 Account number

7 Type of account: Checking

Savings

Part IV Taxpayer or Fiduciary Declaration and Signature Authorization

I authorize an EFW on the date indicated on line 2 for the amount stated on line 1, plus EFWs for the estimated payments to be made on the dates indicated on

line 4, for each amount stated on line 3, corresponding to the estimated payment date. The above EFWs are to be made from the bank indicated on lines 5, 6,

and 7. This authorization will remain in effect unless I contact the FTB to cancel the request. I request that the payment(s) above be deducted from the bank

account on the date specified above. If this date falls on a Saturday, Sunday, or holiday, the transfer is authorized for the next business day. If the FTB cannot

deduct the payment from the account because of insufficient funds or because the bank account is closed, the FTB may charge a dishonored payment penalty. I

will be responsible for any overdraft fees charged by the bank. Under penalties of perjury under the laws of the State of California, I declare that I have completed

this payment authorization to the best of my knowledge and belief; it is true, correct, and complete. I have selected a personal identification number (PIN) as my

signature for my EFW payment request.

Taxpayer or fiduciary’s PIN: check one box only

□

I authorize

to enter my PIN

Do not enter all zeros

ERO firm name

as my signature on my 2016 e-filed California EFW payment request.

□

I will enter my PIN as my signature on my 2016 e-filed California EFW payment request. Check this box only if you are entering your own PIN and your EFW

payment request is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature

Date

Spouse’s/RDP’s PIN: check one box only

□

I authorize

to enter my PIN

Do not enter all zeros

ERO firm name

as my signature on my 2016 e-filed California EFW payment request.

□

I will enter my PIN as my signature on my 2016 e-filed California EFW payment request. Check this box only if you are entering your own PIN

and your EFW payment request is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse’s/RDP’s signature

Date

Practitioner PIN Method Payments Only -- continue below

Part V Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the 2016 California EFW payment request for the taxpayer(s) or fiduciary indicated

above. I confirm that I am submitting this EFW payment request in accordance with the requirements of the Practitioner PIN method and FTB Pub. 1345, 2016

e-file Handbook for Authorized e-file Providers.

ERO’s signature

Date

FTB 8879 (PMT)

2016)

C2 (NEW

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2