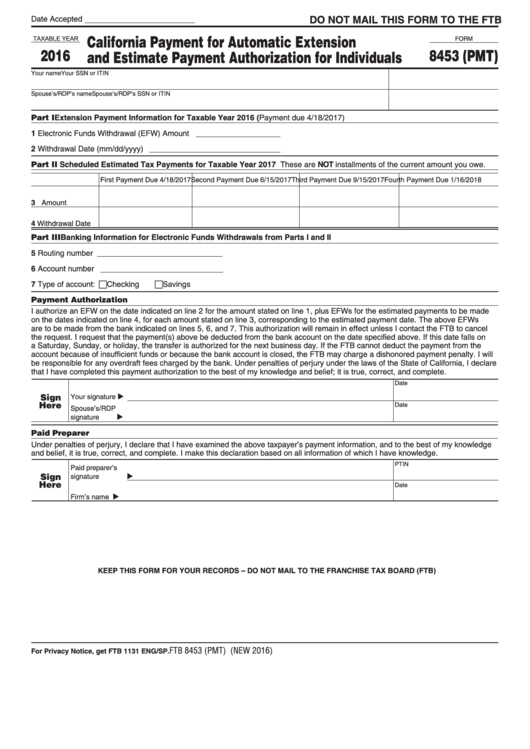

Form 8453 (Pmt) - California Payment For Automatic Extension And Estimate Payment Authorization For Individuals - 2016

ADVERTISEMENT

DO NOT MAIL THIS FORM TO THE FTB

Date Accepted

California Payment for Automatic Extension

TAXABLE YEAR

FORM

2016

8453 (PMT)

and Estimate Payment Authorization for Individuals

Your name

Your SSN or ITIN

Spouse’s/RDP’s name

Spouse’s/RDP’s SSN or ITIN

Part I

Extension Payment Information for Taxable Year 2016 (Payment due 4/18/2017)

1 Electronic Funds Withdrawal (EFW) Amount

2 Withdrawal Date (mm/dd/yyyy)

Part II

Scheduled Estimated Tax Payments for Taxable Year 2017 These are NOT installments of the current amount you owe.

First Payment Due 4/18/2017 Second Payment Due 6/15/2017

Third Payment Due 9/15/2017

Fourth Payment Due 1/16/2018

3 Amount

4 Withdrawal Date

Part III Banking Information for Electronic Funds Withdrawals from Parts I and II

5 Routing number

6 Account number

7 Type of account: Checking

Savings

Payment Authorization

I authorize an EFW on the date indicated on line 2 for the amount stated on line 1, plus EFWs for the estimated payments to be made

on the dates indicated on line 4, for each amount stated on line 3, corresponding to the estimated payment date. The above EFWs

are to be made from the bank indicated on lines 5, 6, and 7. This authorization will remain in effect unless I contact the FTB to cancel

the request. I request that the payment(s) above be deducted from the bank account on the date specified above. If this date falls on

a Saturday, Sunday, or holiday, the transfer is authorized for the next business day. If the FTB cannot deduct the payment from the

account because of insufficient funds or because the bank account is closed, the FTB may charge a dishonored payment penalty. I will

be responsible for any overdraft fees charged by the bank. Under penalties of perjury under the laws of the State of California, I declare

that I have completed this payment authorization to the best of my knowledge and belief; it is true, correct, and complete.

Date

Sign

Your signature

Here

Date

Spouse’s/RDP

signature

Paid Preparer

Under penalties of perjury, I declare that I have examined the above taxpayer’s payment information, and to the best of my knowledge

and belief, it is true, correct, and complete. I make this declaration based on all information of which I have knowledge.

PTIN

Paid preparer’s

Sign

signature

Here

Date

Firm’s name

KEEP THIS FORM FOR YOUR RECORDS – DO NOT MAIL TO THE FRANCHISE TAX BOARD (FTB)

FTB 8453 (PMT) (NEW 2016)

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2