Instructions For Form 589 - Nonresident Reduced Withholding Request - 2018

ADVERTISEMENT

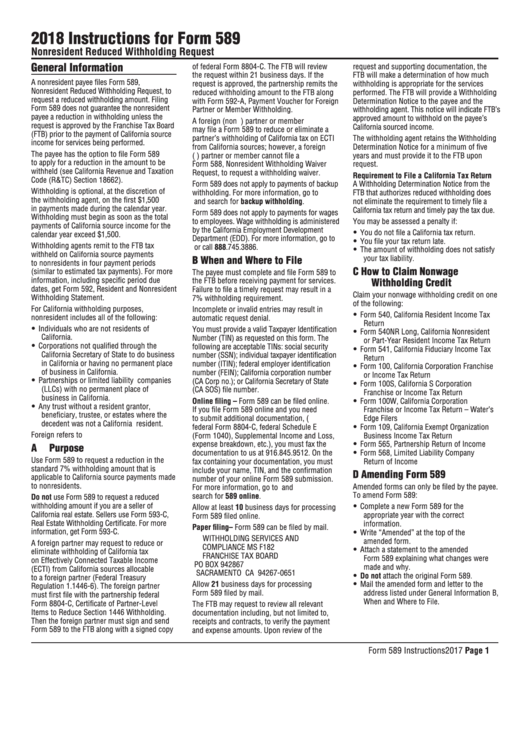

2018 Instructions for Form 589

Nonresident Reduced Withholding Request

General Information

of federal Form 8804-C. The FTB will review

request and supporting documentation, the

the request within 21 business days. If the

FTB will make a determination of how much

A nonresident payee files Form 589,

request is approved, the partnership remits the

withholding is appropriate for the services

Nonresident Reduced Withholding Request, to

reduced withholding amount to the FTB along

performed. The FTB will provide a Withholding

request a reduced withholding amount. Filing

with Form 592-A, Payment Voucher for Foreign

Determination Notice to the payee and the

Form 589 does not guarantee the nonresident

Partner or Member Withholding.

withholding agent. This notice will indicate FTB’s

payee a reduction in withholding unless the

approved amount to withhold on the payee’s

A foreign (non U.S.) partner or member

request is approved by the Franchise Tax Board

California sourced income.

may file a Form 589 to reduce or eliminate a

(FTB) prior to the payment of California source

partner’s withholding of California tax on ECTI

The withholding agent retains the Withholding

income for services being performed.

from California sources; however, a foreign

Determination Notice for a minimum of five

The payee has the option to file Form 589

(non-U.S.) partner or member cannot file a

years and must provide it to the FTB upon

to apply for a reduction in the amount to be

Form 588, Nonresident Withholding Waiver

request.

withheld (see California Revenue and Taxation

Request, to request a withholding waiver.

Requirement to File a California Tax Return

Code (R&TC) Section 18662).

Form 589 does not apply to payments of backup

A Withholding Determination Notice from the

Withholding is optional, at the discretion of

withholding. For more information, go to

FTB that authorizes reduced withholding does

the withholding agent, on the first $1,500

ftb.ca.gov and search for backup withholding.

not eliminate the requirement to timely file a

in payments made during the calendar year.

California tax return and timely pay the tax due.

Form 589 does not apply to payments for wages

Withholding must begin as soon as the total

to employees. Wage withholding is administered

You may be assessed a penalty if:

payments of California source income for the

by the California Employment Development

•

You do not file a California tax return.

calendar year exceed $1,500.

Department (EDD). For more information, go to

•

You file your tax return late.

Withholding agents remit to the FTB tax

edd.ca.gov or call 888.745.3886.

•

The amount of withholding does not satisfy

withheld on California source payments

B

When and Where to File

your tax liability.

to nonresidents in four payment periods

C

How to Claim Nonwage

(similar to estimated tax payments). For more

The payee must complete and file Form 589 to

information, including specific period due

the FTB before receiving payment for services.

Withholding Credit

dates, get Form 592, Resident and Nonresident

Failure to file a timely request may result in a

Claim your nonwage withholding credit on one

Withholding Statement.

7% withholding requirement.

of the following:

For California withholding purposes,

Incomplete or invalid entries may result in

•

Form 540, California Resident Income Tax

nonresident includes all of the following:

automatic request denial.

Return

•

Individuals who are not residents of

You must provide a valid Taxpayer Identification

•

Form 540NR Long, California Nonresident

California.

Number (TIN) as requested on this form. The

or Part-Year Resident Income Tax Return

•

Corporations not qualified through the

following are acceptable TINs: social security

•

Form 541, California Fiduciary Income Tax

California Secretary of State to do business

number (SSN); individual taxpayer identification

Return

in California or having no permanent place

number (ITIN); federal employer identification

•

Form 100, California Corporation Franchise

of business in California.

number (FEIN); California corporation number

or Income Tax Return

•

Partnerships or limited liability companies

(CA Corp no.); or California Secretary of State

•

Form 100S, California S Corporation

(LLCs) with no permanent place of

(CA SOS) file number.

Franchise or Income Tax Return

business in California.

•

Online filing – Form 589 can be filed online.

Form 100W, California Corporation

•

Any trust without a resident grantor,

If you file Form 589 online and you need

Franchise or Income Tax Return – Water’s

beneficiary, trustee, or estates where the

to submit additional documentation, (i.e.

Edge Filers

decedent was not a California resident.

•

federal Form 8804-C, federal Schedule E

Form 109, California Exempt Organization

Foreign refers to non-U.S.

(Form 1040), Supplemental Income and Loss,

Business Income Tax Return

•

expense breakdown, etc.), you must fax the

Form 565, Partnership Return of Income

A

Purpose

•

documentation to us at 916.845.9512. On the

Form 568, Limited Liability Company

Use Form 589 to request a reduction in the

fax containing your documentation, you must

Return of Income

standard 7% withholding amount that is

include your name, TIN, and the confirmation

D

Amending Form 589

applicable to California source payments made

number of your online Form 589 submission.

to nonresidents.

Amended forms can only be filed by the payee.

For more information, go to ftb.ca.gov and

To amend Form 589:

search for 589 online.

Do not use Form 589 to request a reduced

•

withholding amount if you are a seller of

Complete a new Form 589 for the

Allow at least 10 business days for processing

California real estate. Sellers use Form 593-C,

appropriate year with the correct

Form 589 filed online.

Real Estate Withholding Certificate. For more

information.

Paper filing – Form 589 can be filed by mail.

•

information, get Form 593-C.

Write “Amended” at the top of the

WITHHOLDING SERVICES AND

amended form.

A foreign partner may request to reduce or

COMPLIANCE MS F182

•

Attach a statement to the amended

eliminate withholding of California tax

FRANCHISE TAX BOARD

Form 589 explaining what changes were

on Effectively Connected Taxable Income

PO BOX 942867

made and why.

(ECTI) from California sources allocable

SACRAMENTO CA 94267-0651

•

Do not attach the original Form 589.

to a foreign partner (Federal Treasury

•

Allow 21 business days for processing

Mail the amended form and letter to the

Regulation 1.1446-6). The foreign partner

Form 589 filed by mail.

address listed under General Information B,

must first file with the partnership federal

When and Where to File.

Form 8804-C, Certificate of Partner-Level

The FTB may request to review all relevant

Items to Reduce Section 1446 Withholding.

documentation including, but not limited to,

Then the foreign partner must sign and send

receipts and contracts, to verify the payment

Form 589 to the FTB along with a signed copy

and expense amounts. Upon review of the

Form 589 Instructions 2017 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2