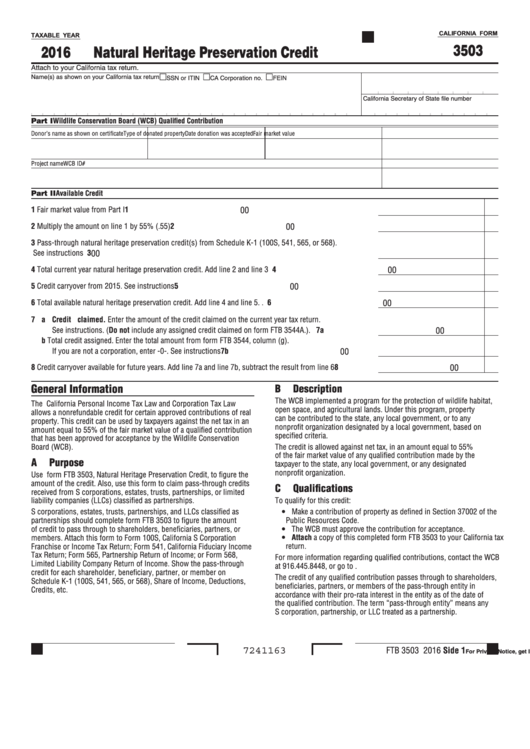

CALIFORNIA FORM

TAXABLE YEAR

3503

2016

Natural Heritage Preservation Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

Part I

Wildlife Conservation Board (WCB) Qualified Contribution

Donor’s name as shown on certificate

Type of donated property

Date donation was accepted

Fair market value

Project name

WCB ID#

Part II Available Credit

1 Fair market value from Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Multiply the amount on line 1 by 55% (.55) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Pass-through natural heritage preservation credit(s) from Schedule K-1 (100S, 541, 565, or 568).

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Total current year natural heritage preservation credit. Add line 2 and line 3. . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from 2015. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Total available natural heritage preservation credit. Add line 4 and line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 a Credit claimed. Enter the amount of the credit claimed on the current year tax return.

See instructions. (Do not include any assigned credit claimed on form FTB 3544A.). . . . . . . . . . . . . . . 7a

00

b Total credit assigned. Enter the total amount from form FTB 3544, column (g).

If you are not a corporation, enter -0-. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

00

8 Credit carryover available for future years. Add line 7a and line 7b, subtract the result from line 6. . . . . . . . 8

00

General Information

B

Description

The WCB implemented a program for the protection of wildlife habitat,

The California Personal Income Tax Law and Corporation Tax Law

open space, and agricultural lands. Under this program, property

allows a nonrefundable credit for certain approved contributions of real

can be contributed to the state, any local government, or to any

property. This credit can be used by taxpayers against the net tax in an

nonprofit organization designated by a local government, based on

amount equal to 55% of the fair market value of a qualified contribution

specified criteria.

that has been approved for acceptance by the Wildlife Conservation

The credit is allowed against net tax, in an amount equal to 55%

Board (WCB).

of the fair market value of any qualified contribution made by the

A

Purpose

taxpayer to the state, any local government, or any designated

nonprofit organization.

Use form FTB 3503, Natural Heritage Preservation Credit, to figure the

amount of the credit. Also, use this form to claim pass-through credits

C

Qualifications

received from S corporations, estates, trusts, partnerships, or limited

To qualify for this credit:

liability companies (LLCs) classified as partnerships.

S corporations, estates, trusts, partnerships, and LLCs classified as

y Make a contribution of property as defined in Section 37002 of the

partnerships should complete form FTB 3503 to figure the amount

Public Resources Code.

y The WCB must approve the contribution for acceptance.

of credit to pass through to shareholders, beneficiaries, partners, or

y Attach a copy of this completed form FTB 3503 to your California tax

members. Attach this form to Form 100S, California S Corporation

Franchise or Income Tax Return; Form 541, California Fiduciary Income

return.

Tax Return; Form 565, Partnership Return of Income; or Form 568,

For more information regarding qualified contributions, contact the WCB

Limited Liability Company Return of Income. Show the pass-through

at 916.445.8448, or go to wcb.ca.gov.

credit for each shareholder, beneficiary, partner, or member on

The credit of any qualified contribution passes through to shareholders,

Schedule K-1 (100S, 541, 565, or 568), Share of Income, Deductions,

beneficiaries, partners, or members of the pass-through entity in

Credits, etc.

accordance with their pro-rata interest in the entity as of the date of

the qualified contribution. The term “pass-through entity” means any

S corporation, partnership, or LLC treated as a partnership.

FTB 3503 2016 Side 1

7241163

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2