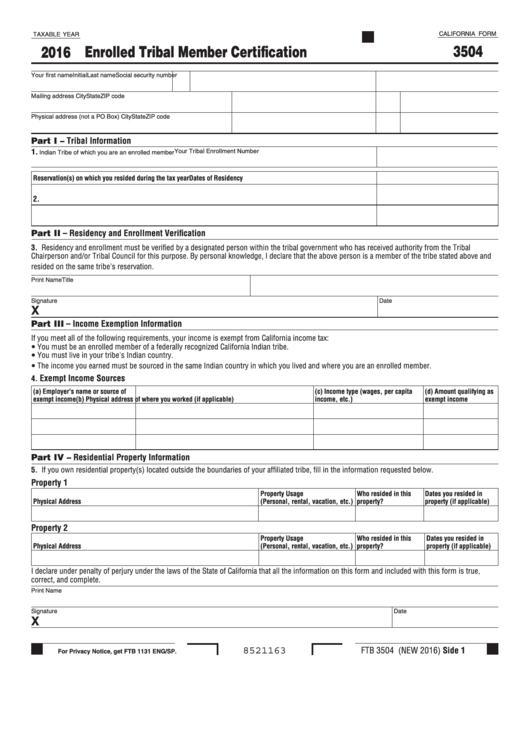

CALIFORNIA FORM

TAXABLE YEAR

3504

2016

Enrolled Tribal Member Certification

Your first name

Initial Last name

Social security number

Mailing address

City

State

ZIP code

Physical address (not a PO Box)

City

State

ZIP code

Part I – Tribal Information

1.

Your Tribal Enrollment Number

Indian Tribe of which you are an enrolled member

Reservation(s) on which you resided during the tax year

Dates of Residency

2.

Part II – Residency and Enrollment Verification

3. Residency and enrollment must be verified by a designated person within the tribal government who has received authority from the Tribal

Chairperson and/or Tribal Council for this purpose. By personal knowledge, I declare that the above person is a member of the tribe stated above and

resided on the same tribe's reservation.

Print Name

Title

Signature

Date

X

Part III – Income Exemption Information

If you meet all of the following requirements, your income is exempt from California income tax:

You must be an enrolled member of a federally recognized California Indian tribe.

You must live in your tribe's Indian country.

The income you earned must be sourced in the same Indian country in which you lived and where you are an enrolled member.

Exempt Income Sources

4.

(a) Employer's name or source of

(c) Income type (wages, per capita

(d) Amount qualifying as

exempt income

(b) Physical address of where you worked (if applicable)

income, etc.)

exempt income

Part IV – Residential Property Information

5. If you own residential property(s) located outside the boundaries of your affiliated tribe, fill in the information requested below.

Property 1

Property Usage

Who resided in this

Dates you resided in

Physical Address

(Personal, rental, vacation, etc.)

property?

property (if applicable)

Property 2

Property Usage

Who resided in this

Dates you resided in

Physical Address

(Personal, rental, vacation, etc.)

property?

property (if applicable)

I declare under penalty of perjury under the laws of the State of California that all the information on this form and included with this form is true,

correct, and complete.

Print Name

Signature

Date

X

FTB 3504 (NEW 2016) Side 1

8521163

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2