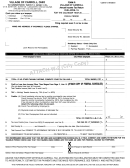

SBT

Sports Bookmaking Tax Return for

(month/year)

Due by the 20th day of the month following the month in which the bets were recorded, accepted, forwarded or placed.

1 Value of bets recorded, accepted, forwarded and/or placed . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

0.06

2 Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax owed (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

You can pay with cash or other negotiable instrument not traceable to yourself. If used, make your check or money order payable to Minnesota Revenue.

Important: You must create a unique 7-digit alpha and/or numeric control number (example:

ABC1234) and enter the same control number on both this tax return and your copy (below).

Control number:

Mail this top portion and your payment to:

Minnesota Revenue, Mail Station 3350, St. Paul, MN 55146-3350

SBT

Sports Bookmaking Tax Return for

(month/year)

Due by the 20th day of the month following the month in which the bets were recorded, accepted, forwarded or placed.

1 Value of bets recorded, accepted, forwarded and/or placed . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

0.06

2 Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax owed (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

You can pay with cash or other negotiable instrument not traceable to yourself. If used, make your check or money order payable to Minnesota Revenue.

Important: You must create a unique 7-digit alpha and/or numeric control number (example:

ABC1234) and enter the same control number on both the tax return and your copy.

Control number:

Taxpayer copy. Keep this bottom portion with your records. It may be the only proof that you

have filed a tax return and paid the tax due for the bets reported on this return.

Rev. 3/04

1

1