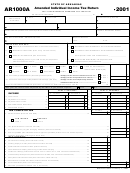

Amended JOBZ M500 Year

M500X

Use this form to amend Form M500, and to report the sales tax incentives the qualified business received for participating in a Job Opportunity

Building Zone (JOBZ),

Name of qualified business

Taxpayer name (if different from JOBZ business)

JOBZ ID number

Business address in the zone

FEIN

City

State

Zip code

County

Minnesota tax ID number

MN

Taxpayer:

C-Corporation

S-Corporation

Partnership

Individual

Fiduciary

Other (specify):

Business contact’s name (first, last)

Title

Daytime phone

Email address of qualified business (optional)

Primary parcel ID (if more than one, attach a sheet)

Reason for amending Form M500

Zone tax benefits

1 Did you receive any zone tax benefits in the year you are amending?

Yes. Continue with line 2.

No. Explain your situation below, sign at the bottom and file this form by the due date:

Sales tax exemptions

2 Purchases you made of tangible personal property (not including capital equipment

or purchases exempt as a part of product production cost) and services primarily used or

consumed in the zone in the year you are amending, that would otherwise have been taxable . . . . . . . . . . . 2

3 Purchases you and/or your contractor made of construction materials and supplies

used to construct or improve real property used by the qualified business in the zone

in the year you are amending . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Purchases made of motor vehicles that are principally garaged in the zone and primarily used

to carry out your zone operations in the year you are amending

(enter each vehicle’s VIN number and purchase price; if you have more than 4 vehicles,

complete Form M500A, JOBZ Motor Vehicle Purchase Report - see instructions) . . . . . . . . . . . . . . . . . . . . . . 4

VIN

$

VIN

$

VIN

$

VIN

$

5 Is the qualified business located in an area with

Enter

a local sales and use tax (see instructions)? . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 No

Yes

the area:

I declare that this report is correct and complete to the best of my kno

wledge and belief.

Signature of authorized representative of qualified business

Date

Do not include Form M500 with your tax return.

Mail this form to:

Minnesota Revenue

Mail Station 9901

St. Paul, MN 55146-9901

Phone: 651-556-6836

Fax: 651-556-3102

Rev. 1/12

1

1 2

2