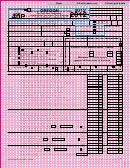

IG255

2012 Nonadmitted Insurance Premium Tax Return for Direct Procured Insurance

Due March 1, 2013

Check if:

Amended return

No activity

Name of insured

Check if new address

Minnesota tax ID (required)

Contact person

Mailing address

Daytime phone

Fax number

City

State

Zip code

Email address

Website address

I am licensed to obtain insurance from nonadmitted insurers

Check if you are a purchasing group

from

to

1 Total gross premiums paid (from page 2, Column G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total return premiums received (from page 2, Column H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Taxable gross premiums paid (subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.02

4 Tax rate is 2% (0 .02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total gross premiums tax due (multiply line 3 by line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 TOTAL AMOUNT DUE (or overpaid) (add lines 5 through 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

If you owe additional tax:

Payment method:

Electronic payment

Check

(payable to Minnesota Revenue; write MN tax ID number on check; attach PV58)

Enter amount paid

Date paid

(If amount paid is different from amount due on line 8, attach an explanation.)

If you overpaid: Overpayments will be refunded .

I declare that this return is correct and complete to the best of my knowledge and belief.

Signature of insured or officer of corporation

Date

Daytime phone

I authorize the

Minnesota Department

of Revenue to discuss

Signature of preparer

Print name of preparer

Date

Daytime phone

this tax return with the

preparer .

Mail to: Minnesota Revenue, Mail Station 1780, St . Paul, MN 55145-1780

1

1 2

2 3

3 4

4