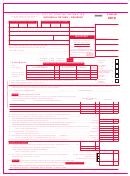

ICCR

2012 Reciprocity Exemption for Individual Construction Contractors

For individual construction contractors (payees) who are Michigan or North Dakota residents

performing work for a construction contractor (payer) in Minnesota

Note: Law Change for Individual Construction Contractors

After June 30, 2012, businesses are no longer required to withhold 2 percent from payments made to in-

dividual construction contractors. For details, go to our website at and see “Law

Change for Individual Construction Contractors” under the What’s New tab in Withholding Tax.

Read instructions on back. Please print.

Individual construction contractor (payee): Complete this form and give it to the construction contractor (payer).

Last name of individual construction contractor (payee)

First name and initial

Social Security number

Permanent home address

City

State (check one)

Zip code

Michigan

North Dakota

Business address (if different than above)

City

State

Zip code

1 I have lived at the above residence since (month and year)

.

2 Do you return to the above residence at least once a month? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO*

* If your answer is NO, you do not qualify for the reciprocity exemption.

3 Were you ever a resident of Minnesota? . . . . . . . . . . . . . . . . . .

YES, from

to

.

NO

(month/year)

(month/year)

Name of current Minnesota construction contractor (payer)

Minnesota tax ID number

Address of Minnesota construction contractor (payer)

Phone

City

State

Zip code

Minnesota

I declare that the above information is correct and complete to the best of my knowledge and belief.

I understand there is a $500 penalty for making false statements.

Signature of independent construction contractor (payee)

Date

Daytime phone

Construction contractor (payer):

Mail this form to Minnesota Revenue, Mail Station 6501, St. Paul, MN 55146-6501.

Keep a copy for your records.

Note: If this form is not filled out completely, you must withhold 2 percent income tax from payments made for work

performed in Minnesota.

1

1 2

2