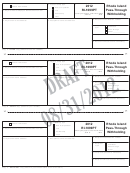

MEMBER/RECIPIENT

Maine

2012

Name, address and ZIP code:

a

Pass-through

Form 1099ME

Withholding

CORRECTED (if checked)

Member/Recipient ID number:

b

Maine income tax withheld directly by the entity listed in box c.

1

(Do not include Real Estate Withholding)

ENTITY/PAYER

Name, address and ZIP code:

c

Maine income tax withheld by lower tier entities

2

Real estate withholding payments

3

Type of entity:

d

Partnership/LLC

S Corporation

Other

Lower tier entity information

4

Name

EIN

Entity federal identifi cation number:

e

a)

Contact information:

b)

f

Name:

c)

Phone number:

d)

PURPOSE OF FORM

Form 1099ME is used to report withholding of Maine income tax from Maine source distributive income for a nonresident owner of a

pass-through entity. This form includes only the amount withheld from the recipient shown in boxes a & b. Form 1099ME is not used to

report wage withholding or estimated income tax payments. Affected members must submit this form with their Maine income tax return

to establish the amount withheld for the year and reported on Form 941P-ME, Schedule 2P - Pass-through Entity Withholding Listing.

For more information about pass-through entity withholding, refer to the MRS web site at

RECIPIENT INSTRUCTIONS

The amounts in boxes 1 and 2 represent Maine income taxes paid on your behalf by the pass-through entity listed in box c or 4. You may claim credit

for these amounts on your Maine income tax return. To receive credit, you must enter the total of boxes 1 and 2 as withholding on your 2010 Maine

income tax return. Your share of this entity’s income will be included on your federal return and will be reported to you separately on Schedule K-1.

The amount in box 3 is your share of income taxes withheld from the purchase price of Maine property sold by the entity during

the year. The buyer of the property has remitted the withheld tax to Maine Revenue Services. The amount reported in box 3

cannot be claimed as withholding on your Maine income tax return; instead, it must be claimed as an estimated tax payment.

NOTE: You will not receive credit for the amounts reported in boxes 1 - 3 unless a copy of this form is attached to your Maine income

tax return.

ENTITY INSTRUCTIONS

After the end of the calendar year and by the following January 31st, the pass-through entity must provide to each affected member

a copy of Form 1099ME (available at or by calling 207-624-7894), showing the pass-through entity

Maine income tax withheld for the year. The pass-through entity is not required to submit a copy of this form to Maine Revenue Services.

Instructions continued on reverse of form.

Rev. 12/11

1

1 2

2