Instructions For Schedule U-Drd - Member'S Dividends Received Deduction - 2012

ADVERTISEMENT

Combined Reporting Instructions

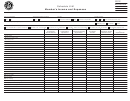

2012 Schedule U-DRD Instructions

Member’s Dividends Received Deduction

Schedule U-DRD must be filed by every member of a combined group, including a non-taxable

member, which claims a deduction with respect to eligible dividends that it has received and

must include in gross income subject to Massachusetts tax. Financial institutions and business

corporations (including S corporations) are allowed a 95% deduction for most dividends received

from other corporations in which they own at least 15% of the voting stock. Utility corporations

are allowed a 100% deduction for any dividends received from other utility corporations in

which they own at least 80% of the voting stock. No deduction is permitted for any dividend

eliminated from the combined group’s taxable income under 830 CMR 63.32B.2(6)(c) or for any

dividend that is otherwise not included in Massachusetts net income.

The deduction calculated on Schedule U-DRD is claimed on the schedule that reports the

dividends that qualify for the deduction. If such dividends are included in the combined group’s

taxable income, the deduction is claimed on Schedule U-E. If such dividends are not included in

the combined group’s taxable income (including that of a Massachusetts affiliated group), the

deduction is claimed on Schedule U-MTI. If no affiliated group election has been made and the

member has both dividends included in the combined group’s taxable income to be reported on

Schedule U-E and dividends included in the member’s separate income from sources other than

the unitary business to be reported on Schedule U-MTI, the member must file two Schedules U-

DRD.

Schedule U-DRD Header

For each Schedule U-DRD filed, enter the name of the member (as stated on its federal income

tax return, if filed), the member’s Federal Identification numbe. Note that the member receiving the

dividends and claiming the dividends received deduction may be a non-taxable member in any

instance in which the dividends are to be included in the combined group’s taxable income.

Check one box to indicate whether the financial institution excise, the utility corporation excise

or the general business corporation excise applies. S Corporations that would be taxable under

M.G.L. c. 63, § 2B if doing business in Massachusetts are considered financial institutions. S

corporations that would be taxable under M.G.L. c. 63, § 32D if doing business in Massachusetts

are considered business corporations. Also enter the unitary business identifier that corresponds

to the schedule on which the dividends are to be reported.

If the combined group is subject to an affiliated group election, all of the member’s income is

included in the combined group’s taxable income. Enter “1” to designate that the deduction will

be claimed on the group’s Schedule U-E.

If the combined group is not subject to an affiliated group election and the dividends are not

derived from the combined group’s unitary business but rather are derived from a source other

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2