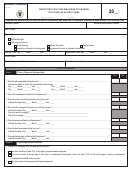

File pg. 5

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

Note: If reporting other income on Form 1, line 9 or Form 1-NR/PY, line 11 and/or claiming other deductions on Form 1, line 15, or Form 1-NR/PY,

line 19, you must complete and enclose the following schedule(s) with your return.

Schedule X Other Income.

2012

Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules.

0 0

1

Alimony received (from U.S. return) (full- and part-year residents only; see instructions). . . . . . . . . 3 1

0 0

2

Taxable IRA/Keogh and Roth IRA conversion distributions (from worksheet) . . . . . . . . . . . . . . . . . . 3 2

0 0

3

Other gambling winnings (sources other than Massachusetts state lottery). Not less than “0” . . . 3 3

Note: Gambling losses are not deductible under Massachusetts law. Do not report Massachusetts

state lottery winnings here; instead, report them on Form 1, line 8b or Form 1-NR/PY, line 10b.

0 0

4

Fees and other 5.25% income. Not less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5

Total other 5.25% income. Add lines 1 through 4. Not less than “0.” Enter here and on Form 1,

0 0

line 9 or Form 1-NR/PY, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

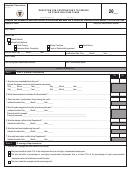

Schedule Y Other Deductions.

Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules.

1

Allowable employee business expenses (from worksheet). (Non-residents and part-year residents,

0 0

this deduction must be related to income reported on Form 1-NR/PY). . . . . . . . . . . . . . . . . . . . . . . . 3 1

2

Penalty on early savings withdrawal (from U.S. return). (Nonresidents and part-year residents, this

0 0

deduction must be related to income reported on Form 1-NR/PY) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3

Alimony paid (from U.S. return). Part-year residents, enter the amount paid while a Massachusetts

0 0

resident; nonresidents, multiply alimony paid by line 14g of Form 1-NR/PY . . . . . . . . . . . . . . . . . . . 3 3

4

Amounts excludible under MGL Ch. 41, sec. 111F or U.S. tax treaty included in Form 1, line 3 or

0 0

Form 1-NR/PY, line 5. Fill in applicable oval below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

Income received by a firefighter or police officer incapacitated in the line of duty, per MGL Ch. 41, sec. 111F

Income exempt under U.S. tax treaty

0 0

5

Moving expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

0 0

6

Medical savings account deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

0 0

7

Self-employed health insurance deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

0 0

8

Health savings accounts deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9

Certain qualified deductions from U.S. Form 1040 (see instructions)

0 0

Certain business expenses from U.S. Form 1040 (see instructions). . . . . . . . . . . . . . . . . . . . . . 3 9

10

Student loan interest deduction (from U.S. Form 1040 or 1040A; only if not claiming the same

0 0

expenses in line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

0 0

11

College Tuition Deduction (from worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12

Undergraduate student loan interest deduction (only if not claiming the same expenses in line 10;

0 0

see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13

Deductible amount of qualified contributory pension income from another state or political

0 0

subdivision included in Form 1, line 4 or Form 1-NR/PY, line 6 (see instructions) . . . . . . . . . . . . . . 3 13

0 0

14

Claim of right deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

0 0

15

Commuter deduction (from worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

0 0

16

Human organ donation deduction (full-year residents only; see instructions). . . . . . . . . . . . . . . . . . 3 16

17

Total other deductions. Add lines 1 through 16. Enter here and on Form 1, line 15 or Form 1-NR/PY,

0 0

line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

1

1