2012

INSTRUCTIONS FOR FORM 740-V

ELECTRONIC FILING PAYMENT VOUCHER

Do I need to use a payment voucher?

•

If you owe tax on your 2012 electronic Kentucky return, send

only the payment voucher with your payment. You

must pay the amount you owe by April 15, 2013, to avoid interest and penalties.

•

If your 2012 electronic Kentucky return shows a refund or no tax due, do not use the payment voucher.

Why use a payment voucher?

•

The Department of Revenue does not issue statements of liability prior to the April 15 deadline for payment.

•

For balance due returns, taxpayers should complete Form 740-V and submit it along with payment. To avoid

penalties and interest, payments should be postmarked on or before April 15, 2013.

•

The use of Form 740-V, Kentucky Electronic Payment Voucher, will help process your payment more accurately

and efficiently. Do not send a copy of your electronically filed return with payment of tax due.

How do I prepare my payment?

•

Make your check or money order payable to the

Kentucky State Treasurer. Do not send cash.

•

If your name and address are not printed on your check or money order, write them on the check or money

order.

•

Write your Social Security number, daytime phone number and “2012 Form 740” on your payment.

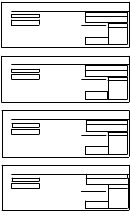

How do I prepare the payment voucher?

•

Enter your Social Security number in box 1.

•

If you are filing a joint or combined return, enter your spouse’s Social Security number in box 3.

•

Enter your name(s) and address in box 2.

•

Enter your daytime phone number in box 4.

•

Enter the amount of the payment you are making in box 7.

How do I send in my payment and the payment voucher?

•

Detach the payment voucher at the dotted line below.

•

Do not attach the payment voucher and the check or money order to each other.

•

Mail your payment and payment voucher to:

Kentucky Department of Revenue, Frankfort, KY 40620-0011.

DETACH HERE AND MAIL VOUCHER WITH YOUR PAYMENT.

Please cut along dotted line.

2012

740-V

42A740-S23

Department of Revenue

K

ENTUCKY

D

N

send a copy of your electronically filed return with payment

➤

o

ot

E

P

V

LECTRONIC

AYMENT

OUCHER

of tax due. Please use Form 740-V to submit your payment.

1 Enter your Social Security number

2 Last Name

First Name

5

Additional Tax Due (Form 740, line 40)

$

3 If a joint or combined return, enter

Mailing Address (Number and Street or P.O. Box)

6

Interest, File Late and Pay Late Penalties

your spouse’s Social Security number

$

4 Daytime Telephone number

City, State and ZIP Code

7

Total Payment

$

Mail to: Kentucky Department of Revenue, Frankfort, KY 40620-0011.

1

1