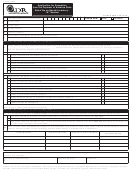

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

COUNTY USE ONLY

CalWORKS - REDUCED INCOME SUPPLEMENTAL PAYMENT

DATE POSTMARKED

SUPPLEMENTAL MONTH

REQUEST

YOU MAY GET EXTRA MONEY IF THE COUNTY IS COUNTING INCOME

CASE NUMBER

WORKER NAME/NUMBER

.

AGAINST YOUR CASH AID AND THAT INCOME HAS DROPPED OR STOPPED

A. ACTUAL GRANT AMOUNT

•

You must use this form to ask for the extra money.

(RISP Month)

$

•

You can only get extra money if your income, other than cash aid, dropped or

B. RISP MONTH ESTIMATED NET INCOME

stopped. You cannot use this form to get extra money for other reasons such as

1.

Total Disability-Based Unearned

$ ______________

birth of a child, clothing needs for children returning to school, or if you need to

Income (Income of AU and Non-AU Members)

move.

2.

$225 Disregard

- ______________

You must apply in the month that you need the extra money, not before or after.

•

3.

Subtotal Nonexempt Disability Based

You must complete and return a separate form during each month that the

•

Income (B1 minus B2)

county is counting income that has dropped or stopped.

(Enter positive amounts in B9)

(Enter negative amounts in B5)

= ______________

The county must determine your eligibility for extra money within 7 working days

after the date this completed form is received. If you don't need the form this month,

4.

Gross Earned Income

keep it for later.

(AU and Non-AU)

$ ______________

5.

Remainder of $225 Income Disregard - ______________

(Enter amount from line B3 if negative)

Questions? Ask your worker.

6.

Subtotal Earned Income

= ______________

(B4 minus B5)

Worker Name:

Phone: (

)

1.

Complete the following:

7.

50% Earned Income Disregard

- ______________

CASE NAME

YOUR SOCIAL SECURITY NUMBER

(B6 divided by 2)

8.

Subtotal (B6 minus B7)

= ______________

2.

Explain about the income that dropped or stopped. Complete below:

(Net Nonexempt Earned Income)

What Income Changed?

When?

Why Did It Change?

9.

Nonexempt Unearned Disability

Based Income

+ ______________

(Enter amount from line B3 if positive)

10. Other Countable Income of Family

3.

Attach proof of the change in income (Job Termination Notice, Social Security

____________________________

+ ______________

Notices, Disability/Unemployment Insurance Notices, Statements, etc.). If you

have no proof, list the employer or agency that can be contacted:

____________________________

+ ______________

EMPLOYER/AGENCY

PHONE

11. Net Nonexempt Income of Family

(

)

(Sum total of B8, B9 and B10)

$ ______________

ADDRESS

C. RISP MONTH AVAILABLE INCOME

1.

Actual Grant Amount (Enter from A)

$ ______________

4.

List money you expect to get this month of_____________________.

(CURRENT MONTH)

(Do not list your grant amount.)

2.

O/P adjustment (if used in actual

grant computation)

+ ______________

3.

Special Need (if used in actual

INCOME

SOURCE OF INCOME

grant computation)

- ______________

Gross Earnings

$

4.

Child/Spousal Support Disregard

+ ______________

Other Income

$

5.

Net Nonexempt Income

(Enter from B11)

+ ______________

6.

Penalties

CERTIFICATION

(Such as 25% Non-Co-op, school attendance, and immunization)

•

I understand that the statements I have made on this form are subject to investigation

______________________________

+ ______________

and verification including contacting the above named person, employer or agency.

______________________________

+ ______________

•

I further declare under penalty of perjury under the laws of the United States of

America and the State of California that the statements I have given on this form are

7.

Total Available Income

$ ______________

true and correct to the best of my knowledge.

D. RISP PAYMENT

•

I authorize the county to obtain any verification of income and circumstances

1. 80% of AU MAP

$ ____________

necessary to process this request. This authorization is valid for 30 days from the

date signed.

2. Total Available Income

(Enter from C7)

- ____________

SIGNATURE

DATE SIGNED

3. RISP Payment

$ ____________

SIGNATURE OF SPOUSE OR OTHER ADULT RECIPIENT

DATE SIGNED

PHONE

MESSAGE PHONE

APPROVED

DENIED

(

)

(

)

WORKER SIGNATURE

DATE

On this form, disclosure of your Social Security Number (SSN) is voluntary. The SSN will

be used to identify you and your records. If we cannot identify you, you may not get any

extra money.

CW 40 (ENG/SP) (3/00) APPLICATION FOR REDUCED INCOME SUPPLEMENTAL PAYMENT - REQUIRED FORM - SUBSTITUTE PERMITTED

1

1