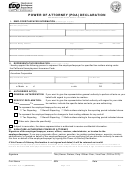

POWER OF ATTORNEY (POA) DECLARATION

SEE INSTRUCTIONS ON THE BACK OF THIS FORM.

I. EMPLOYER/TAXPAYER INFORMATION

(please type or print)

California Employer Payroll Tax Account

Taxpayer Identification Number:

Federal Employer Identification Number:

Number: (if applicable)

Owner/Corporation Name:

Social Security Number (SSN)/Corporate Identification Number:

Business Name/Doing Business As (DBA):

Business Mailing Address:

City:

State:

ZIP Code:

Business Phone Number:

Business Fax Number:

Business Location (if different from above):

City:

State:

ZIP Code:

II.

REPRESENTATIVE DESIGNATION

(please type or print)

I hereby appoint the following person to represent the employer/taxpayer for specified tax matters arising under

the California Unemployment Insurance Code.

Representative’s Business:

Representative’s Name:

Phone Number:

Fax Number:

Business Mailing Address:

City:

State:

ZIP Code:

III.

AUTHORIZED ACT(S)

GENERAL AUTHORIZATION: If you want to give the representative general authority to perform all acts on your

behalf with regard to your state tax matters.

SPECIFIC DECLARATION:

If you want to give the representative limited authority with regard to your state

From

To

tax matters, indicate the specific dates and acts you are authorizing.

To represent the employer/taxpayer for any and all

☐ Tax Reporting

☐ Benefit Reporting ☐ Both matters relating to the reporting period indicated above.

To represent the employer/taxpayer for changes to their mailing address for any and all

☐ Tax Reporting

☐ Benefit Reporting ☐ Both matters relating to the reporting period indicated above.

Other acts: (describe specifically) _________________________________________________________

Subject to revocation, the above representative is authorized to receive confidential information.

IV. SIGNATURE AUTHORIZING POWER OF ATTORNEY

Signature of the employer/taxpayer, owner, officer, receiver, administrator, or trustee for the

employer/taxpayer: If you are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver,

administrator, or trustee on behalf of the employer/taxpayer, you are certifying that you have the authority to execute

this form on behalf of the employer/taxpayer by signing this Power of Attorney Declaration.

If this Power of Attorney Declaration is not signed and dated, it will be returned as invalid.

I certify under penalty of perjury that the above information is true, correct, and complete, and that these actions are not to be taken to

receive a more favorable Unemployment Insurance rate. I further certify that I have the authority to sign on behalf of the above business.

Signature

Title (Owner, Partner, Corp. Officer: Pres., Vice Pres., CEO or CFO)

Print Name

SSN

Date

DE 48 Rev. 8 (5-17) (INTERNET)

Page 1 of 2

CU

1

1 2

2