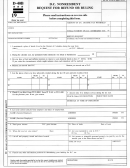

Form D-40b - Nonresident Request For Refund - 2015

ADVERTISEMENT

Government of the

*150401110000*

D-40B Nonresident

2015

District of Columbia

Request for Refund

Important: Print in CAPITAL letters using black ink. Leave lines blank that do not apply.

Personal information

OFFICIAL USE ONLY

Vendor ID#0000

Your first name

Last name

M.I.

Your social security number

Your date of birth (MMDDYYYY)

Daytime phone number

Current mailing address (number, street and suite/apartment number if applicable)

City

State

Zip Code + 4

Country or U.S. commonwealth/U.S. territory

Review categories 1 - 2 below and attach your withholding statements.

1. Commuter/Domiciliary State Exemption: I declare that during the taxable year shown above I either commuted on a daily basis

from my place of residence to work in the District of Columbia (DC) or I was a domiciliary or legal resident of the state listed

and my only income from sources within DC was from wages and salaries, which are subject to taxation by (enter the 2 letter

state abbreviation for your domiciliary or legal state of residency) I did not maintain a place of abode in DC for a total of more

than 183 days. (see instructions). DC tax was erroneously withheld from salary and wages paid to me by my employer.

2. Military spouse exemption: If your non-resident military spouse was in the armed services during 2015, and you are not a DC

resident, enter the state of domicile declared on DD Form 2058.

3. List the type and location of any DC real property you own.

Type of property

Address (number, street and suite/apartment number if applicable)

Type of property

Address (number, street and suite/apartment number if applicable)

Refund request

Round cents to nearest dollar. If amount is zero, leave line blank.

$

.00

1

1.

DC income tax withheld

Attach copies of your withholding statements.

$

.00

2

2.

2015 DC estimated income tax payments

$

.00

3

3.

Refund request

Add Lines 1 and 2.

Will the refund go to an account outside the US?

Yes

No

See instructions.

Refund Options:

For information on the tax refund card and program limitations, see instructions or visit our website otr.dc.gov/refundprepaidcards.

Mark one refund choice:

Direct Deposit

Tax Refund Card

Paper Check

Direct Deposit

I

f you want your refund deposited in your bank account, fill in type of account

checking

savings and enter the routing number and account

number below.

Routing Number

Account Number

Signature

Under penalties of law, I declare that I have examined this request and any attached statements, and, to the best of my knowledge, they are correct.

Your signature

Date

Preparer’s signature

Preparer’s Tax Identification Number (PTIN)

Revised 09/2015

2015 D-40B P1 Nonresident Request for Refund

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1