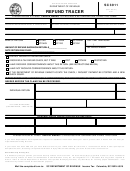

Form Rv066 - Exemption Certificate - South Dakota Department Of Revenue

ADVERTISEMENT

Exemption Certificate

South Dakota Department of Revenue

RV066

Revised 01/03

445 E. Capitol Avenue | Pierre, SD 57501-3100 | 1-800-TAX-9188

.

THIS CERTIFICATE IS NOT VALID IF THE PURCHASER DOES NOT INDICATE BASIS FOR THEIR EXEMPTION

.

INFORMATION ON EXEMPT TRANSACTIONS IS ON THE BACK OF THIS FORM

N

a

m

e

o

f

P

u

r

c

h

a

s

e

r

T

e

e l

p

h

o

n

e

N

u

m

b

e

r

S

t

r

e

e

t

A

d

d

r

e

s

s

C

t i

y

S

t

a

t

e

/

Z

i

p

C

o

d

e

N

a

m

e

o

f

S

e

l

e l

r

Any purchaser who knowingly and intentionally lists items for resale that he/she knows will not be resold, or provides an invalid exemption certificate with the

intent to evade payment of the tax is guilty of a Class 1 misdemeanor and may be fined up to fifty percent of the tax in addition to the tax. SDCL 10-45-61

The undersigned certify that they have read this document and that the statements regarding the purchase, use or resale of each of the items are true. The

undersigned are fully aware of the consequences that will result from the misuse of this certificate. The undersigned further asserts that they have the authority

to complete and submit this document on behalf of the above named business.

A

u

t

h

o

r

i

z

e

d

S

i

g

n

a

t

u

r

e

T

i

l t

e

N

a

m

e

D

a

t

e

The person signing this certificate MUST check the applicable box showing the basis for the exemption from sales tax and provide the purchaser’s tax permit

or exemption number. Tax permit numbers containing the letters “ET” or “UT” can not be used for tax-free purchases.

1. Government Entity

South Dakota Exemption #_____ - ______ - ____________ - _____ - ______

I certify that the tangible personal property or services purchased are to be paid directly with funds from the entity noted on this form.

“Directly” does not include per diem, cash advances, or similar indirect payments. Government entities are not required to furnish

exemption numbers.

2. Non-profit Hospital

South Dakota Tax Permit #_____ - ______ - ____________ - _____ - ______

I certify that the items are being purchased by an authorized official of the non-profit hospital; that payment is made from non-profit

hospital funds; and the non-profit hospital retains title to the property.

3. Relief Agency

South Dakota Exemption #_____ - ______ - ____________ - _____ - ______

I certify that the items or services purchased are to be paid directly with funds from the entity noted.

4. Religious or Private Educational Institutions South Dakota Exemption #_____ - ______ - ____________ - _____ - ______

I certify that the items are being purchased by an authorized official of the religious or private educational institution; that payment is

made from religious or private educational institutions funds; and the religious or private educational institution retains title to the

property.

5. Agricultural Products and Services - I certify the items and services purchased will be used for exclusive agricultural purposes only.

6. Farm Machinery - I certify that the farm machinery, attachment unit, or irrigation equipment being purchased is to be used

exclusively for agricultural purposes and qualifies for the 3% sales and use tax rate.

7. Direct Payment Permit

South Dakota Direct Payment Permit #______________________________

I certify the entity listed on this form has a Direct Payment Permit and will accrue and pay the use tax directly to the Department.

8. Resale or Re-lease

Tax Permit #___________________________________________________

If no permit number is available, provide reason:

Describe nature of your business:

Describe the items for which you are claiming exemption for:

DO NOT SEND THIS CERTIFICATE TO THE DEPARTMENT OF REVENUE. KEEP IT WITH YOUR RECORDS IN CASE OF AN AUDIT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2