Form Rc321 E - Delegation Of Authority Form Page 2

ADVERTISEMENT

Protected B

when completed

Delegation of Authority

Read all the instructions before filling in this form.

Use this form to assign a delegated authority (DA) to deal with the Canada Revenue Agency (CRA) on the business' behalf, or to cancel an existing DA. Send

this completed form to your tax centre (see Instructions). Make sure you fill in this form correctly, since we cannot change the information that you provide.

You can also add, modify, or cancel a DA by using the "Authorize or manage representatives" services directly in "My Business Account" at

mybusinessaccount. The DA must have a RepID (obtained through the "Represent a Client" (RaC) service at representatives) prior to

completing this form, or using the online service.

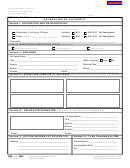

Part 1 – Business information

Complete this part to identify the business. Provide the name of the business as registered with the CRA.

Business number:

Business name:

Part 2 – Authorize a delegated authority

The delegated authority will be able to deal with us online, by telephone or by mail. The name of the individual provided below must be the same name

registered with the RaC service. Access will not be granted if the name registered with RaC differs from the one provided on this form or if a RepID has not

been provided.

•

Notes:

Completing this authorization gives the DA access to the "Authorize or manage representatives" service, the program account information, and

other services in "My Business Account." A delegated authority can access these online services through the RaC service.

•

See "Permissions" on page 1 for the permissions given to the delegated authority.

RepID:

Name of delegated authority:

Telephone number:

Part 3 – Select access to program accounts

If you want to provide your DA access to all program accounts, tick the first box. You may grant access to all program accounts under a specific program by

providing the applicable program identifier and ticking the "All program accounts" box. You may grant access to a specific program account number by

entering the program identifier and reference number. You may also automatically expire authorization by entering an expiry date. Otherwise, the

authorization will remain in effect until you cancel it. If more than two program identifiers are required, complete another form.

This delegation of authority applies to:

Expiry date

(YYYY-MM-DD)

All program accounts

OR

Only the following program accounts:

Program

All program

Program

Reference

Expiry date

Expiry date

identifier

accounts

identifer

number

(YYYY-MM-DD)

(YYYY-MM-DD)

OR

OR

Part 4 –

Cancel one or more delegated authorities

Complete this part only to cancel authorizations. For more information, see the instructions for Part 4.

A. Cancel all DA authorizations for all program accounts.

B. Cancel all DA authorizations, only for the delegated authorities identified below.

C. Cancel all DA authorizations, only for the following program account:

Program identifier:

Reference number:

D. Cancel authorization for the DA identified below for the following program account:

Program identifier:

Reference number:

RepID:

Name of delegated authority:

RepID:

Name of delegated authority:

Part 5 – Certification

You must sign and date this form. The CRA must receive this form within six months of the date it was signed or it will not be processed. This form must only be signed

by an individual with proper authority for the business, for example, an owner, a partner of a partnership, a corporate director, an officer of a non-profit organization, a

trustee of an estate, or an individual with delegated authority. An authorized representative cannot sign this form unless they have delegated authority. If the name of the

individual signing this form does not exactly match CRA records, this form will not be processed. Forms that cannot be processed, for any reason, will be returned to the

business. To avoid processing delays, you must make sure that the CRA has complete and valid information on your business files before you sign this form.

By signing and dating this form, you authorize the CRA to deal with the individual listed in Part 2 of this form or cancel the authorization of the delegated authority listed in

Part 4. We may contact you to confirm the information you have provided. For more information, see instructions for Part 5.

The individual signing this form is:

an owner

a corporate director

a trustee of an estate

a partner of a partnership

an officer of a non-profit organization

an individual with delegated authority

First name:

Last name:

Title:

Telephone number:

I certify that the information given on this form is correct and complete.

Signature:

Date (YYYY-MM-DD):

Privacy Act, personal information bank numbers CRA PPU 175 and CRA PPU 223.

RC321 E (14)

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2