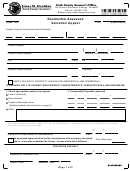

Cook County Assessor's Office

Joseph Berrios

RESIDENTIAL

COOK COUNTY ASSESSOR APPEAL NUMBER

R

118 N. Clark Street - 3rd Floor

Cook County Assessor

Chicago, Illinois 60602

Tax Year 2017 Real Estate Assessed Valuation Appeal

Hours: 8:30 A.M.- 5:00 P.M.

RECEIVED AND CHECKED BY:

List in ascending order all Permanent Index Numbers

PLEASE COMPLETE ALL PARTS OF THE APPEAL FORM. TYPE OR PRINT ALL INFORMATION. COMPLY WITH ASSESSORS OFFICE RULES AND

REGULATIONS IN FILLING OUT AND FILING THIS FORM

associated with the subject property.

IF AIR RIGHTS PROPERTY, SUBMIT PLAT OF SURVEY.

CERTIFICATE OF ERROR

SUBJECT PROPERTY PERMANENT

IDENTIFICATION AND STATUS OF OWNER / TAXPAYER

YEAR(S)

INDEX NUMBER(S) [PINS]

2016

2015

2014

Name of Taxpayer / Owner

1

Address

Email

2

1

City

State

Zip Code

Phone

3

4

Owner

Former Owner Liable for Tax

Tenant Liable for Tax

Executor

Beneficiary of Trust

5

Select one:

Other (Explain)

6

NATURE OF APPEAL - LOCATION AND IDENTIFICATION OF REAL ESTATE

LIST COMPARABLE PROPERTY PINS

BELOW

Appeal Type:

Current Year Appeal Only

Current Year & C of E

C of E Only

Taxable

Exempt

Street Address

1

Location of Subject

City

Township

2

Property:

3

2

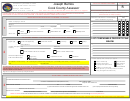

DATA SUBMITTED WITH APPEAL

DATA TO BE SUBMITTED

4

5

How is the Subject Property

6 Apartments or Less

Mixed Use

Single Family

used? Check all that apply.

Check appropriate reason(s) for appeal:

Other (Explain)

Lack of Uniformity

Overvaluation

If purchased on or after January 1, 2014, indicate year purchased and purchase price. If purchased prior to January 1, 2014 insert "prior".

Vacancy/Occupancy

Fire Damage

Purchase Price

Year

Property Description Error

Building is

Uninhabitable

The undersigned states that he/she has read this appeal, has personal knowledge of the contents thereof, and the same is true in substance and in fact and further so certifies

Building no longer exists

under the penalties as provided by law pursuant to section 1-109 of the Illinois Code of Civil Procedure. NOTE: FAILURE TO FILE OWNER / LESSEE AFFIDAVIT MAY

Other (if other, you must provide a narrative

RESULT IN DENIAL OF THIS APPEAL.

using the appeal narrative form)

Signature of Taxpayer or Attorney / Representative

ATTORNEY / REPRESENTATIVE ONLY

ATTORNEY/REPRESENTATIVE CERTIFICATION: I

ATTORNEY / REPRESENTATIVE NAME (PRINT OR TYPE)

FIRM / COMPANY NAME

certify that I have obtained from

3

FIRM / COMPANY ADDRESS

CITY

ZIP

PHONE

TAXPAYER NAME

(1) explicit authorization to file this 2017 assessment appeal and/or Certificate of Error and

(2) the Taxpayers assurance that I am the only attorney

TAXPAYER TITLE OR POSITION

Representative so authorized.

Attorney / Representative Fax Number

Attorney / Representative Signature and Code Number

e-mail Address

NOTICE TO FILERS:

YOU WILL BE NOTIFIED BY MAIL OF THE APPEAL NUMBER. YOU CAN FIND YOUR APPEAL NUMBER AND CHECK APPEAL STATUS ONLINE @

THIS FORM MUST BE PRESENTED IN DUPLICATE. FILE 1ST COPY WITH COOK COUNTY ASSESSOR'S OFFICE - RETAIN TIME STAMPED 2ND COPY FOR YOUR RECORDS.

1

1 2

2