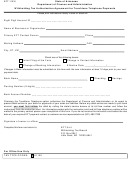

Form EFT-001 ACH Debit Method Instructions

This form is for taxpayers who pay via ACH Credit Method who

wish to change to ACH Debit Method

NOTE: Non-ACH Credit Method payers can pay online via Debit Method without pre-registration.

ACH Credit Method payers must complete the following information to change to

ACH Debit Method:

Taxpayer’s Name/Address:

State the legal name of applicant, and the mailing address of the applicant.

Tax Type:

State the type of tax you are reporting. For example: Sales Tax, Sellers Use Tax, Consumers Use

Tax, Rental Tax, Local Sales/Use Taxes, Utility Tax, Withholding Tax, Corporate Income Tax,

Business Privilege, Tobacco Tax, Oil & Gas Severance Tax, etc.

Tax Account Number:

State the tax account number used to report the tax type as specified above. For example: Sales

Tax Account

Number 5100 12345; Sellers Use Tax Account Number 68SU-12345; Rental Tax Account

Number 7668-12345;

Local Sales/Use Tax Account Number 9501012345; Withholding Tax Account Number

0000123456; Corporate

Income Tax Account Number 12-3456789. Do NOT enter your Social Security Number.

Contact Person/Title/Phone/Fax/Email/Address:

The EFT contact person is the individual whom the Alabama Department of Revenue will contact

if there is a question concerning an EFT payment made by the taxpayer. Any correspondence

concerning the Alabama EFT Tax Payment Program will be directed to your designated EFT

contact person.

Signature:

The EFT Authorization Form must be signed by the owner or an officer of the company

requesting the ACH Debit Payment method.

_____________________________

For additional information pertaining to the EFT Payment Program, please visit our Web

site at

or call 1-800-322-4106, option 7

for a representative.

1

1 2

2